Processing 300-400 invoice/month

1 AP Clerk (at usd $20 per hour)

$9-12 per invoice

in efficiency of manual data entry achieved by American Piping Products from the 1st month itself using Star Automation.

“ When Coilplus was migrating Stratix, we were faced with the monumental task of supplying our customers with the same personalized document and barcode tag customizations they were receiving from our in-house ERP system. Star Software was able to not only create our forms and tags, but their software allowed us to add additional fields not available using the out-of-the-box Star Automation. Their willingness to alter their working hours, provide daily updates on each customization design and having the ability to spin up additional skilled developer resources to meet our deadlines proved to be the difference between a good implementation and a great one! Coilplus considers Star Software a valued business partner and we appreciate their dedication to our customers as if they were their own. They are constantly developing new software for OCR scanning possibilities, creating CSX programs for needed functionality, Star Software an opportunity to let you know what they can do for you. ”

“ Star Automation is a game changer, Best in class Invoice Data Extraction. High accuracy, easy to implement, excellent support team! ”

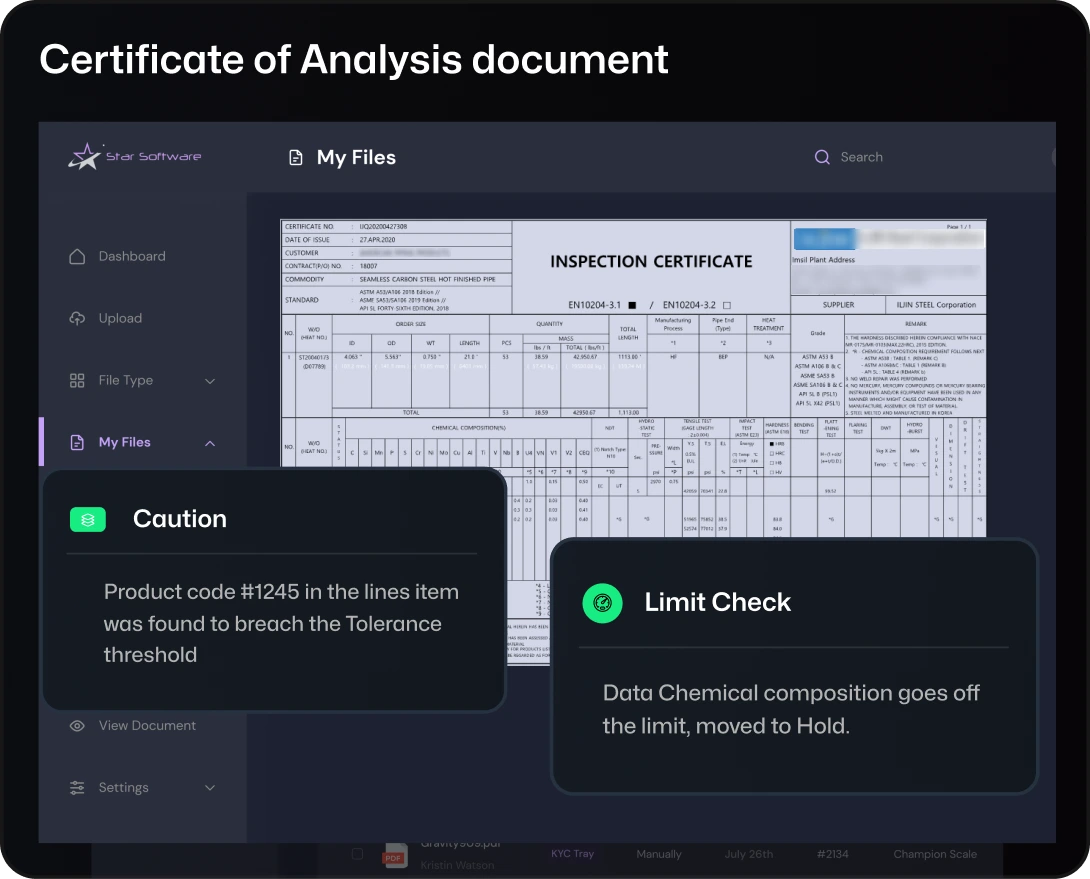

“ We are pleased about the Test Certificate/Report automation software that Star Software developed.. In our business, the test certificate is the value of our product so maintaining traceability is critical. Equally as critical is the accessibility to the data on test cert. The software Star developed to ‘read’ the certificate and to map that output to the Quality Data System in our ERP makes the data very accessible to all of our users. The software is easy to use on a daily basis enabling the Purchasing and Quality departments to upload certificates much more efficiently than we did prior to implementation. The OCR functionality allows us to have access to the data of which we used to have to rely on opening a PDF and reading multiple pages. We look forward to working with Star as we look to expand the scope and use of this tool. ”

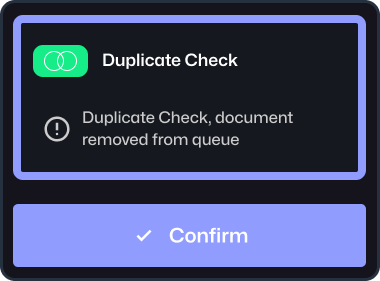

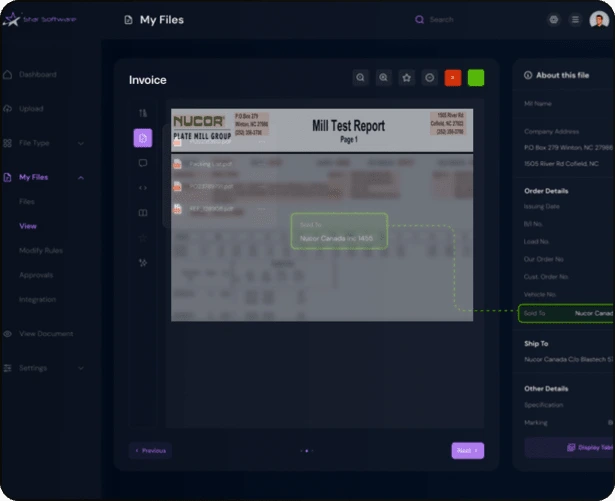

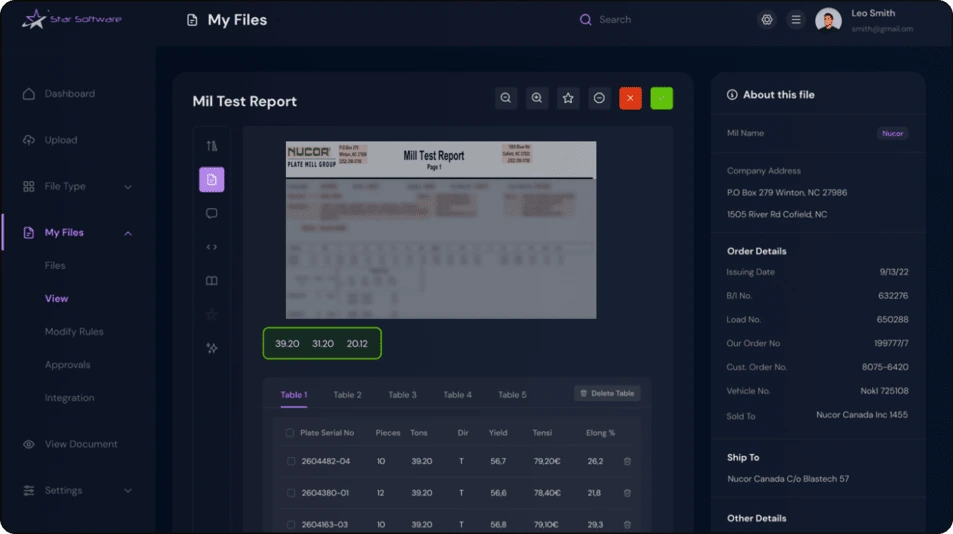

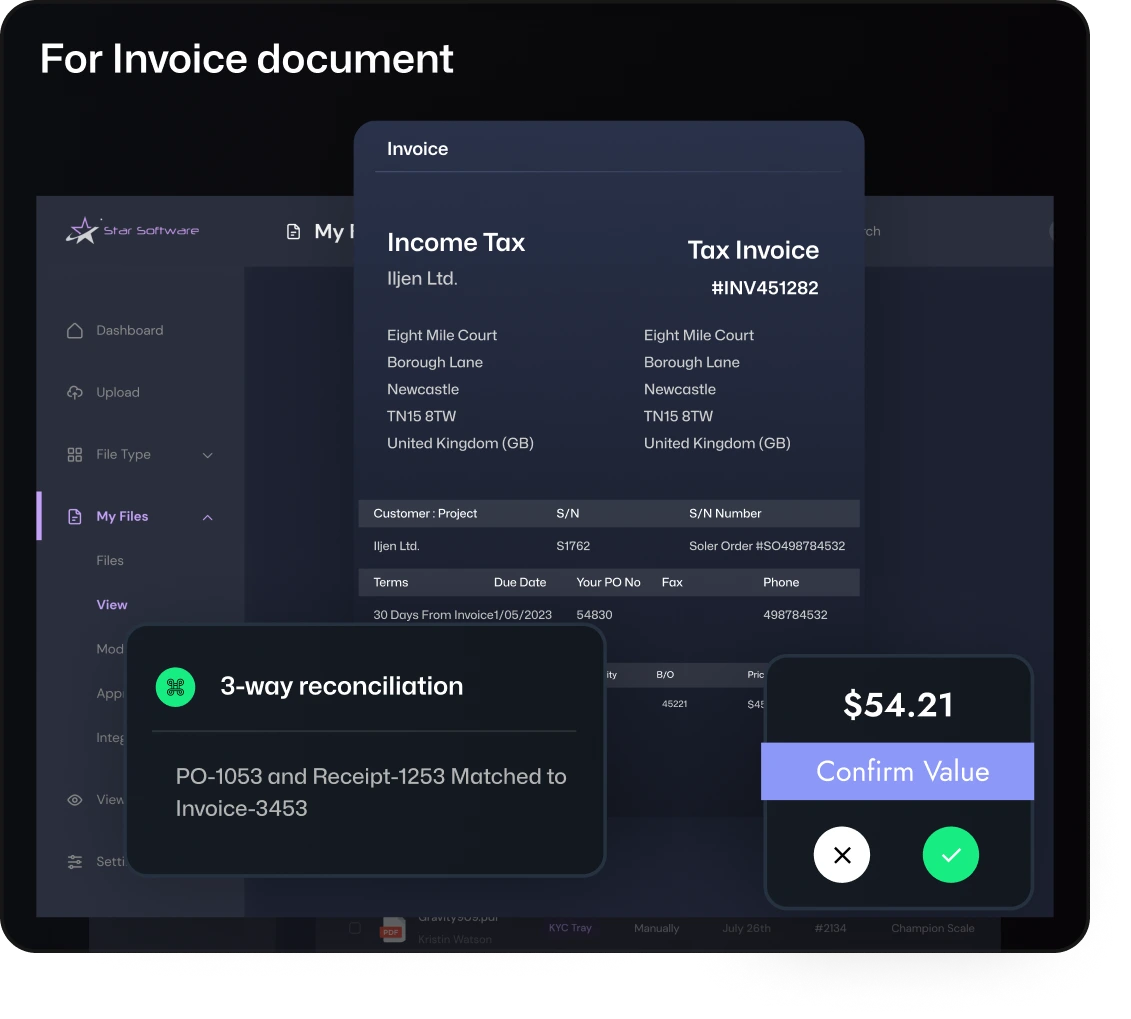

Our AI-based software program has great flexibility and it starts with the wide variety of document types we accept, including PDF, PNG, Excel, email, TIFF, and JPG. Upload documents into the system directly or using an API. Before processing begins, the system will automatically check for duplicate documents, saving you processing time.

With advanced OCR software, you can capture even the most complex forms of information. Whether processing tables, invoices, shipping orders, purchase orders, insurance papers, bank statements, certificates, or material test reports, your complex data and customized fields pose no concern.

in manual document review error from the 2nd month itself because of Star AI Validation

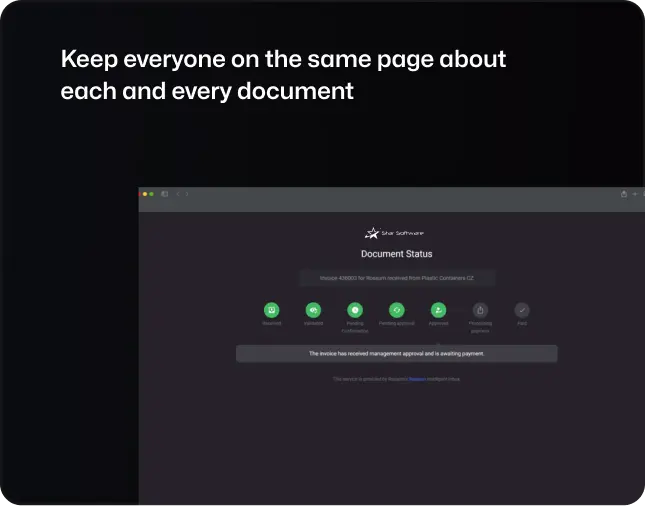

Star document automation gets better with time. Using advanced AI technology, the system continues to learn with each use, improving its efficiency and impact on your bottom line. Customize workflows and add processing functions, such as document validation, to reduce manual interaction.

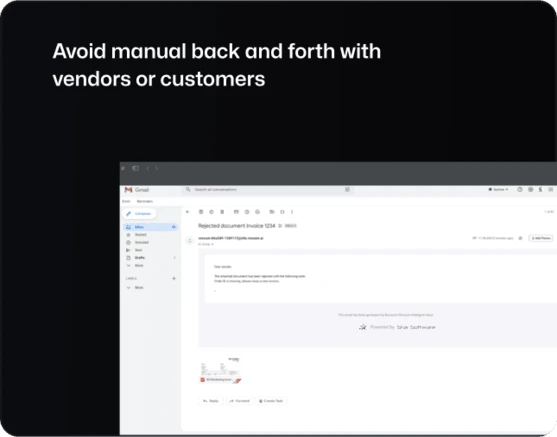

When document processing is complete, follow-up communications can also be automated to save you time. With integration capabilities, send information back to ERP or DMS platforms to close the loop. Or, if working directly with others, the system can send communications alerting them of document status, including any missing information that requires attention.

In operation costs and 100% user satisfaction while switching to Star Automation

We have ready to use solutions for most common documents types. Create and set up your own customs model in few click

Take a spin with an informative demo and see how StarSoftware Works in action.

Request a Demo