Effective loan verification in commercial lending is essential for minimizing risk and ensuring transparency in borrowers’ financial profiles. By thoroughly verifying each applicant, lenders can assess creditworthiness and dependability, safeguarding against potential defaults or fraud. However, traditional verification methods can be slow, labor-intensive, and prone to human error, especially when handling large volumes of varied documents. This is where AI steps in, streamlining the verification process and delivering enhanced accuracy and efficiency for lenders across every stage.

Challenges in Commercial Loan Verification

Commercial loan verification requires lenders to assess multiple documents, including financial statements, credit histories, tax returns, and business documents. Some key challenges include:

- Document Quality and Completeness: Loan documents come in all shapes and sizes, often including scans or photographs that may be low-quality, incomplete, or inconsistent in format.

- Time-Consuming Data Extraction: Traditional data extraction from these documents is labor-intensive and requires careful attention to detail, resulting in slower processing times and potentially higher costs.

- Fraud Detection: Identifying fraudulent documents is a top priority, but with sophisticated forgery tactics, manual verification alone may not be sufficient to catch every red flag.

Given these challenges, lenders are increasingly leveraging AI-driven automation to streamline verification, improve data accuracy, and bolster fraud detection capabilities.

The Role of AI in Transforming Commercial Loan Verification

AI technologies, particularly advanced applications like computer vision and natural language processing (NLP), offer several powerful tools for overcoming verification challenges. Here’s how AI is making a difference:

1. Ensuring Document Quality with Computer Vision

Computer vision algorithms analyze the quality of loan documents before processing begins, ensuring that each file meets required standards. This includes:

- Image and Text Clarity: AI algorithms assess image quality, clarity, and completeness, flagging low-resolution images or incomplete scans for further review.

- Format Standardization: Machine learning tools can standardize document formats, reducing inconsistencies and making it easier to organize and process data from diverse sources.

- Automatic Flagging of Errors: With AI, documents that fail to meet quality standards can be automatically flagged, eliminating time-consuming manual checks and reducing error rates.

By ensuring high document quality from the start, AI enhances data accuracy and reduces the need for re-submission or correction, which can delay the loan verification process.

2. Accelerating Data Extraction with Natural Language Processing

Natural Language Processing (NLP) has enabled AI-powered automation to “read” and understand large volumes of complex text quickly and accurately. NLP in commercial loan verification contributes to:

- Rapid Data Extraction: NLP tools can extract key details from various documents, such as names, dates, financial figures, and loan terms, significantly reducing the time required for manual data entry.

- Enhanced Accuracy: Automation powered by NLP reduces the risk of human error in data extraction, providing accurate data for assessing a borrower’s financial position.

- Real-Time Data Analysis: NLP enables real-time analysis of large datasets, allowing lenders to make faster, data-informed decisions during the loan approval process.

For commercial lenders, these capabilities mean fewer bottlenecks, faster loan approvals, and a streamlined verification process that meets the demands of today’s fast-paced financial environment.

3. Identifying Fraud with AI-Driven Pattern Recognition

Fraud detection is one of the most critical aspects of loan verification. AI’s pattern recognition abilities make it an invaluable tool in identifying potential fraud, including:

- Detecting Anomalies: AI algorithms can detect anomalies by comparing borrower information against typical loan application patterns. For example, unusual data or atypical formatting can trigger alerts for potential fraud.

- Cross-Referencing Data: AI can cross-reference data across multiple documents and external sources to ensure consistency and authenticity, identifying discrepancies that might indicate document forgery.

- Red-Flagging Based on Historical Data: By analyzing historical data, AI models learn what fraudulent activity typically looks like, allowing them to flag high-risk applications for further scrutiny. Machine learning helps improve these models over time, increasing accuracy and lowering the chance of false positives.

AI’s role in fraud detection is especially impactful for commercial lenders who handle large volumes of applications, where subtle signs of fraud might otherwise be missed. This proactive approach can save both time and money, while reducing reputational risks associated with lending to fraudulent borrowers.

Benefits of AI-Powered Commercial Loan Verification for Lenders

The adoption of AI in commercial loan verification delivers several key benefits to lenders:

- Improved Accuracy and Efficiency: By automating repetitive tasks, AI reduces the risk of human error and accelerates the loan verification process, allowing lenders to process more applications in less time.

- Lower Operational Costs: Automating document analysis and data extraction reduces the need for manual labor, resulting in substantial cost savings.

- Enhanced Risk Management: AI helps lenders identify and avoid high-risk or fraudulent applicants more effectively, protecting them from potential losses.

- Better Client Experience: Faster processing times mean shorter waiting periods for borrowers, improving overall satisfaction and strengthening client relationships.

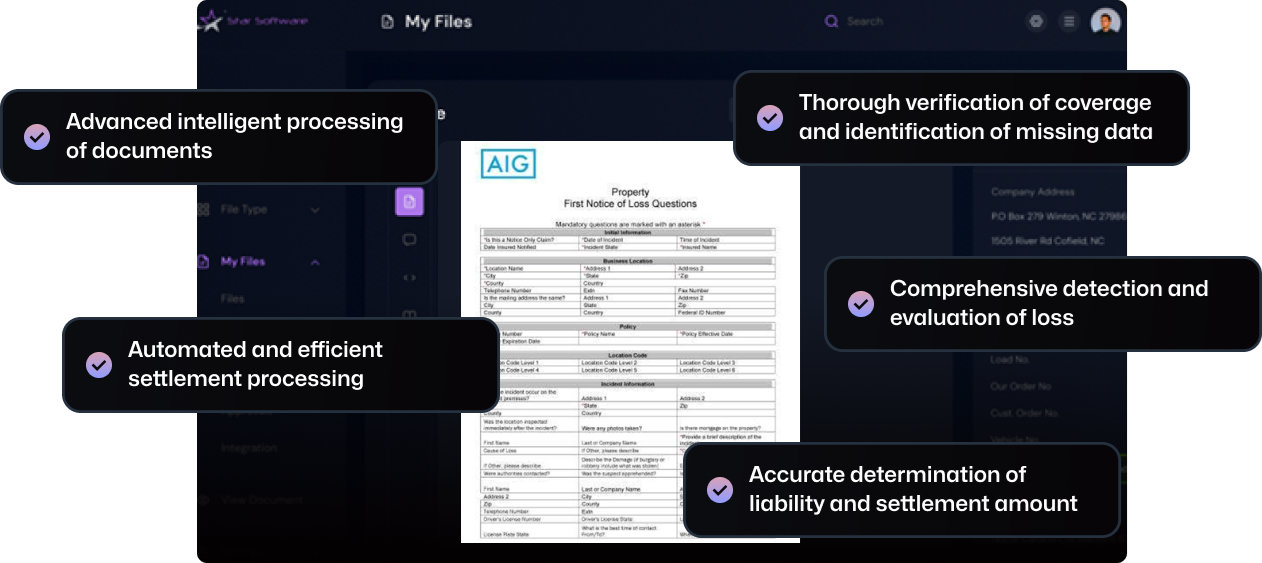

AI in Action: Star Automation’s Solution for Commercial Loan Verification

Star Automation provides AI-powered solutions that enable commercial lenders to streamline onboarding and verification. By using a combination of computer vision, NLP, and machine learning, Star Automation offers:

- Automated Image and Document Analysis: Ensuring that loan documents meet quality standards before they’re processed.

- Intelligent Data Extraction: Extracting essential information from financial documents and reports quickly and accurately.

- Advanced Fraud Detection: Identifying and flagging anomalies or high-risk applications, empowering lenders to make informed decisions.

With AI-powered automation, Star Automation transforms the commercial loan verification process, providing lenders with a faster, more reliable, and secure way to assess loan applications.

Looking Ahead: The Future of AI in Commercial Lending

As AI technology continues to advance, its role in commercial loan verification will likely expand. Future applications may include predictive analytics to forecast a borrower’s financial trajectory or deeper integrations with other financial systems to provide even richer datasets for lenders. With these advancements, AI promises to make commercial lending more accurate, efficient, and secure, benefiting both lenders and borrowers in a fast-evolving financial landscape.

The role of AI in commercial loan verification is pivotal, offering solutions that address key challenges in document quality, data extraction, and fraud detection. For commercial lenders, AI-powered automation isn’t just a tool—it’s a transformative approach that enhances the reliability, speed, and security of the loan verification process. By adopting AI-driven solutions, lenders can meet the demands of modern commercial lending and stay competitive in a data-driven financial world.