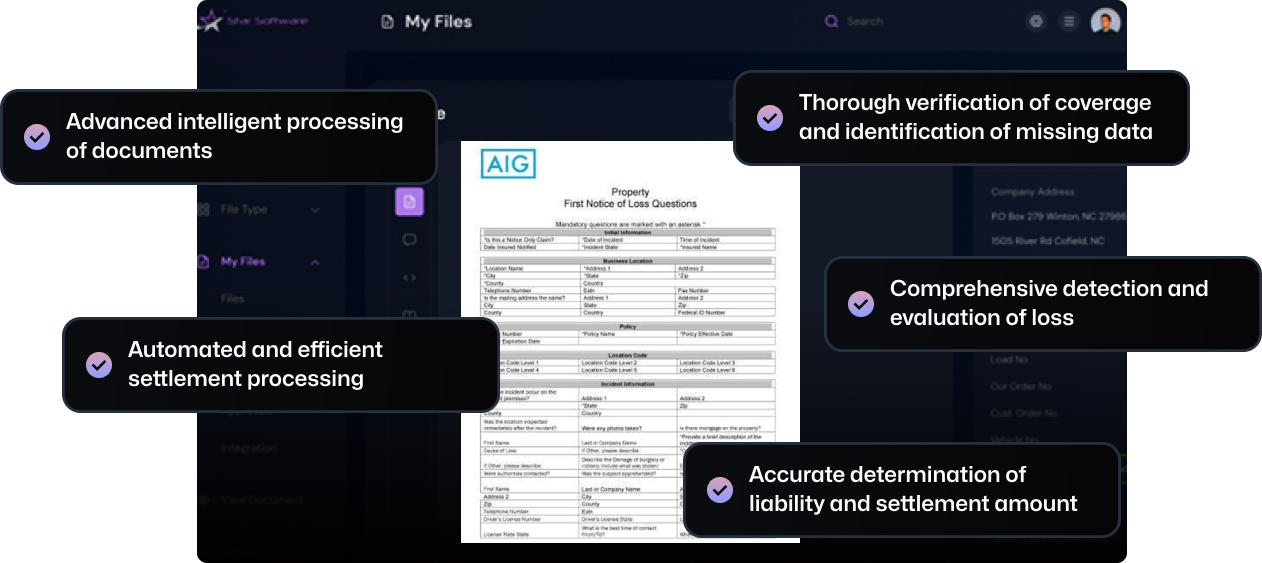

Smart Solutions for Commercial Lenders: Star Automation's OCR and AI Integration

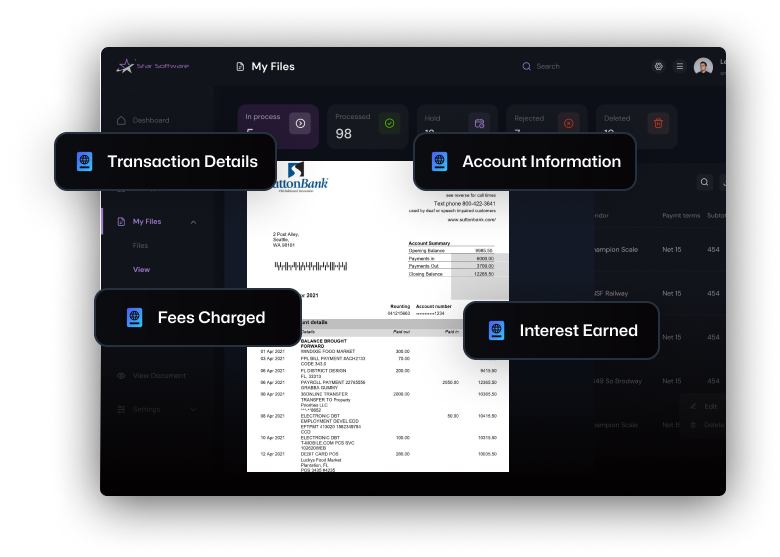

Bank Statement

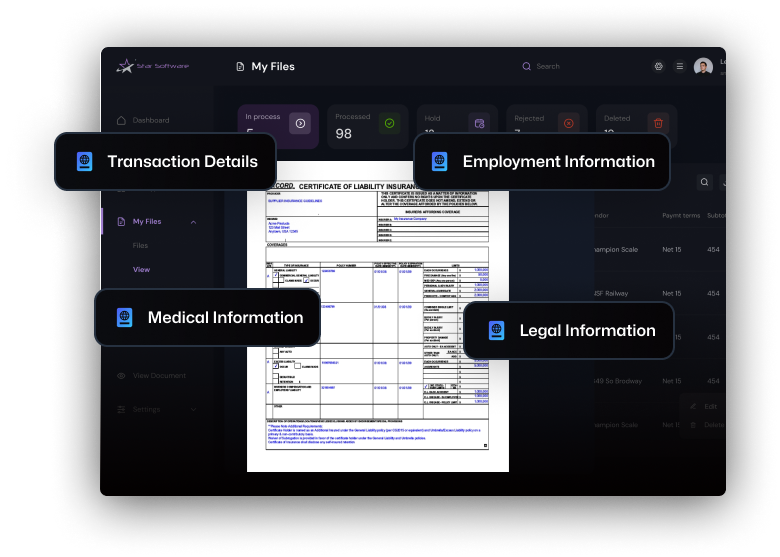

Accord forms

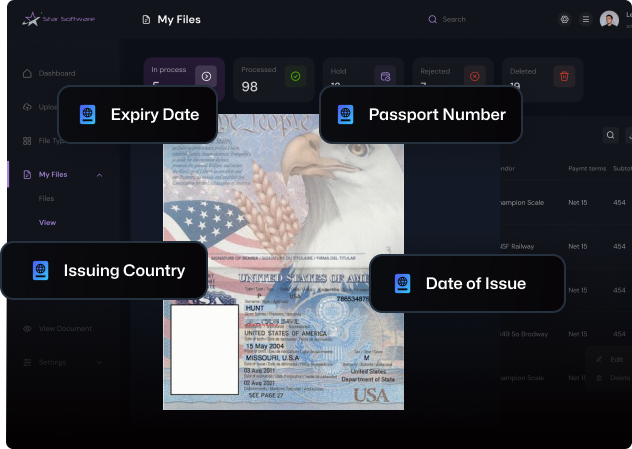

Passport

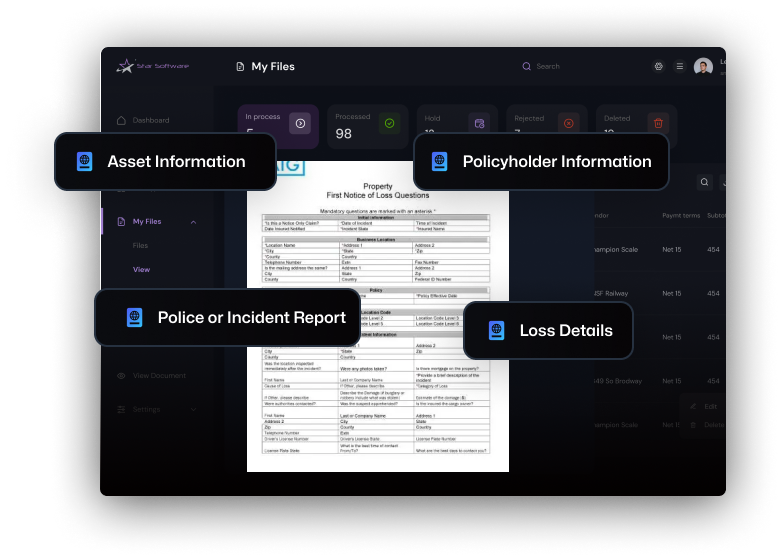

FNOL

Star Software’s Document Automation, powered by OCR and AI, is a transformative force for the commercial lending sector. Through streamlined document processing, enhanced verification, cost-cutting measures, efficient inspection services, and proactive fraud detection, commercial lenders can navigate a future where digital expertise is the key to staying ahead.