Smart Solutions for KYC Verification & Client Onboarding

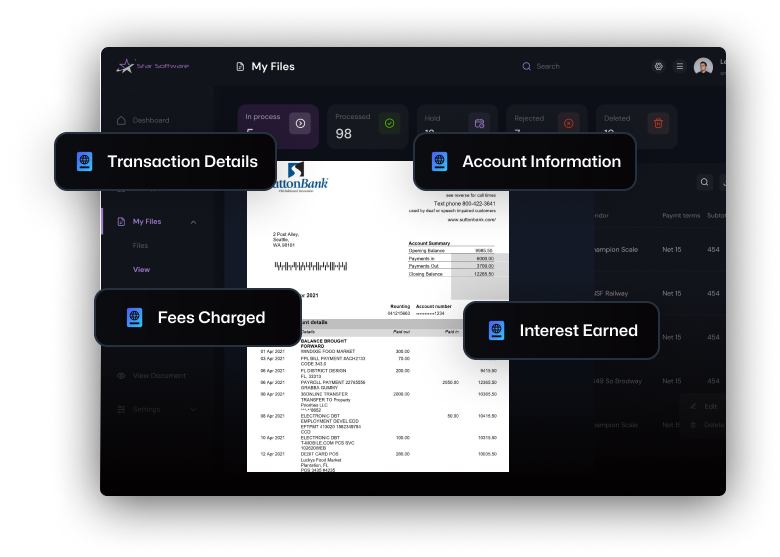

Bank Statement

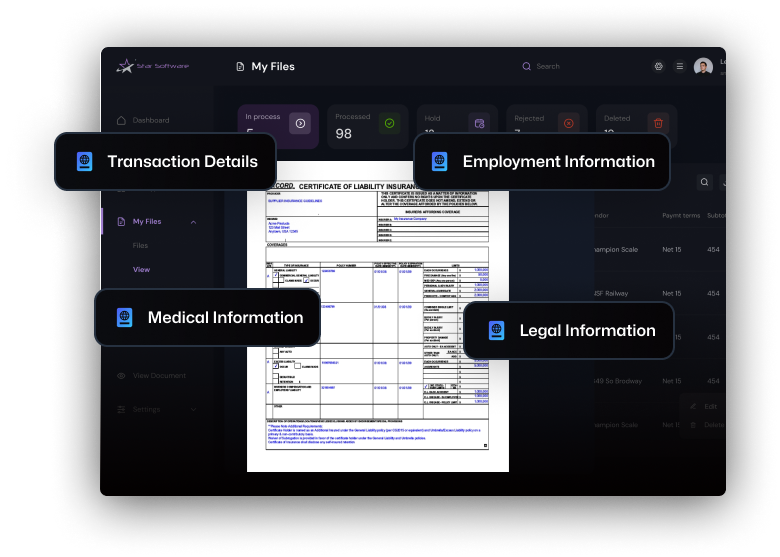

Accord forms

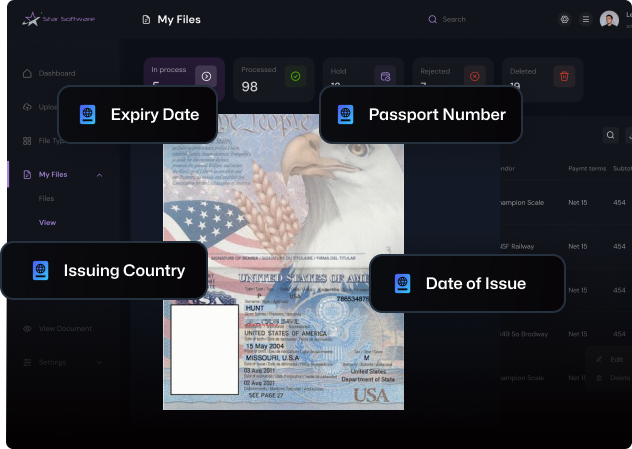

Passport

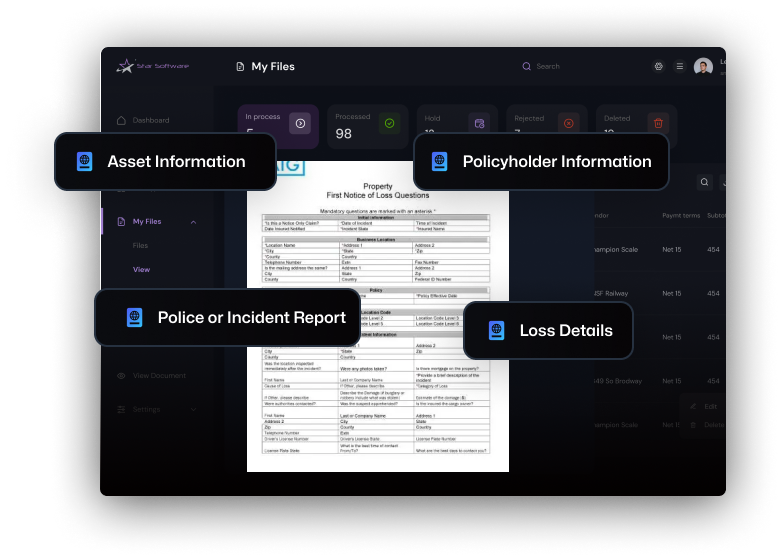

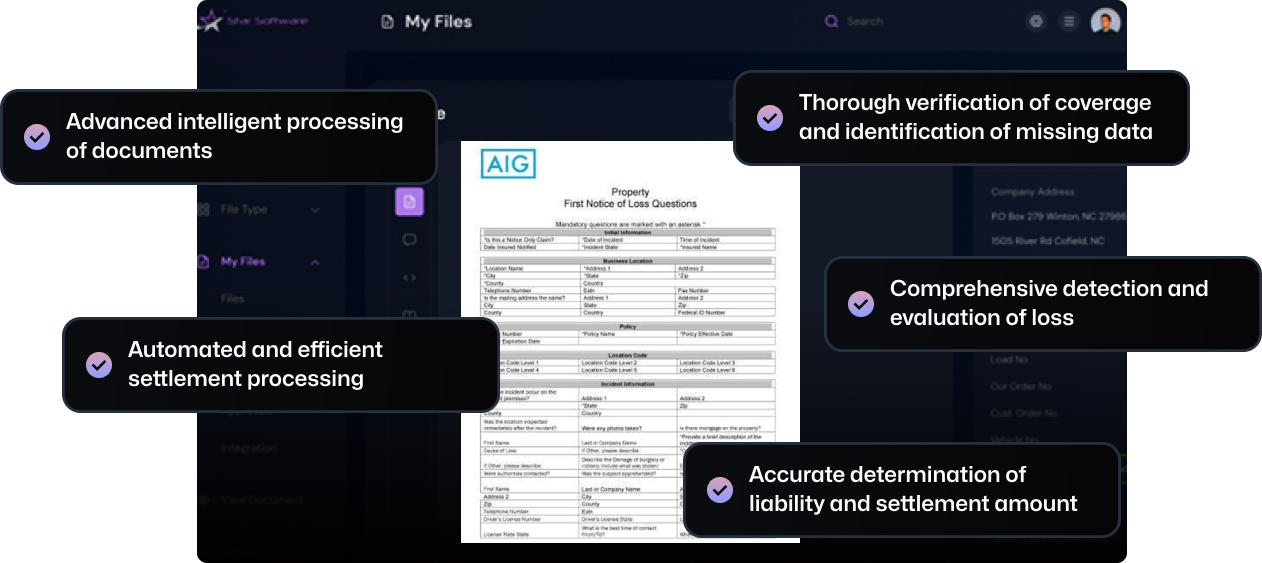

FNOL

Star Software’s Document Automation, empowered by OCR and AI, is a revolutionary force for the KYC verification and client onboarding processes. Through streamlined document processing, enhanced verification, cost-cutting measures, efficient inspection services, and proactive fraud detection, businesses engaged in KYC processes can embrace a future where digital expertise is instrumental in staying ahead.