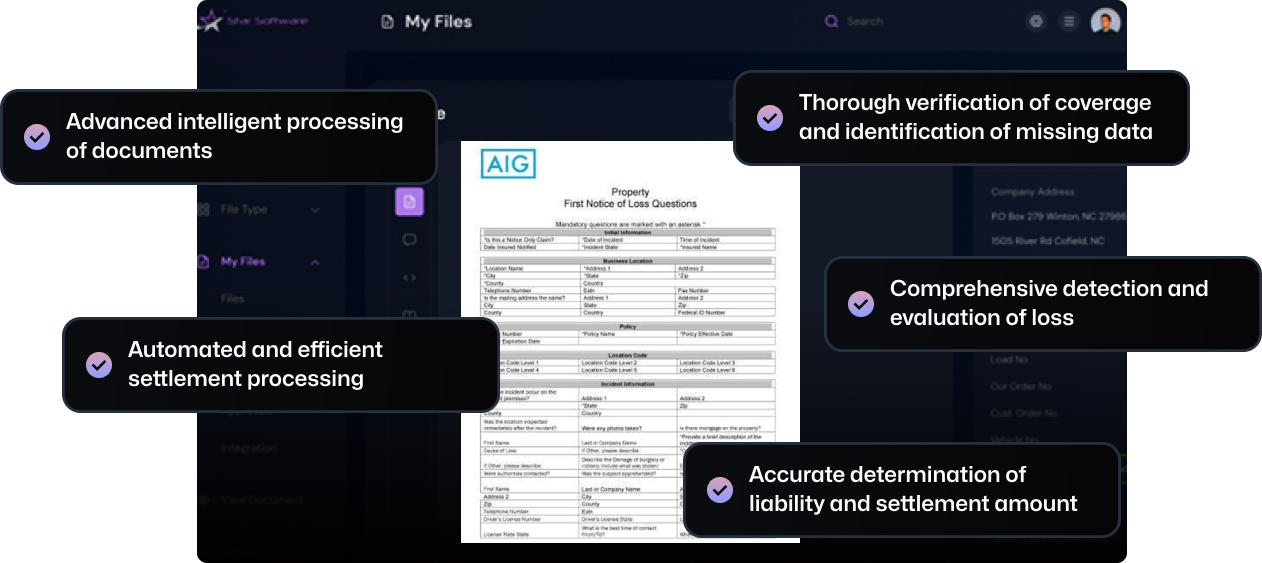

Revolutionizing the Insurance Sector with OCR and AI

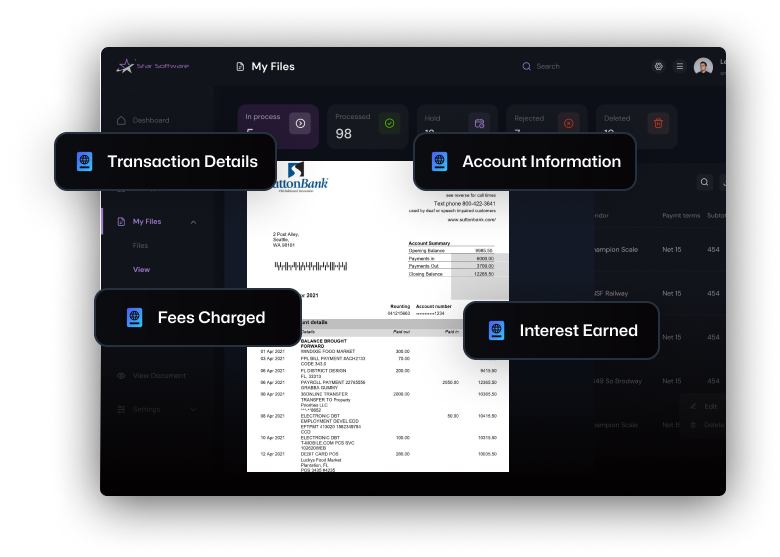

Bank Statement

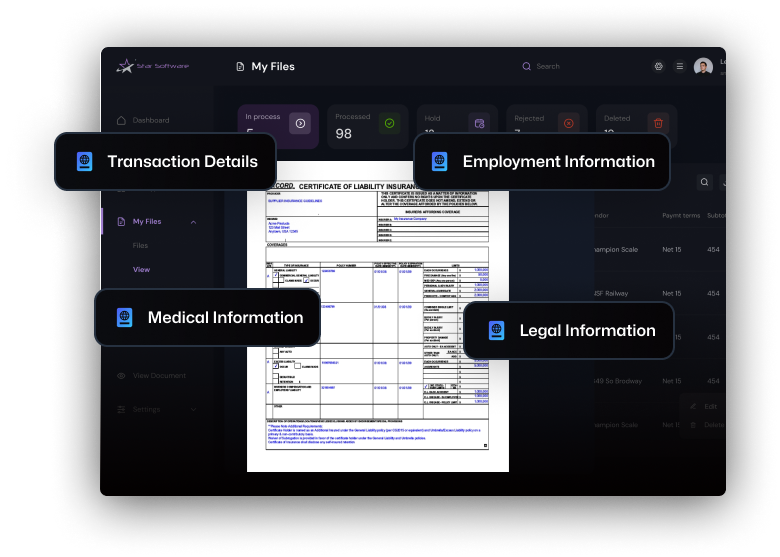

Accord forms

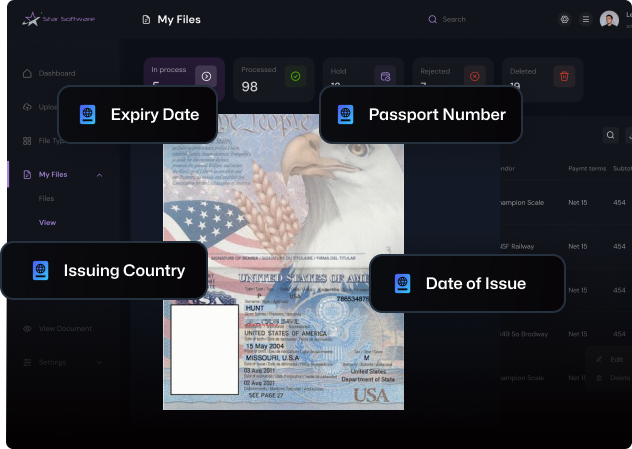

Passport

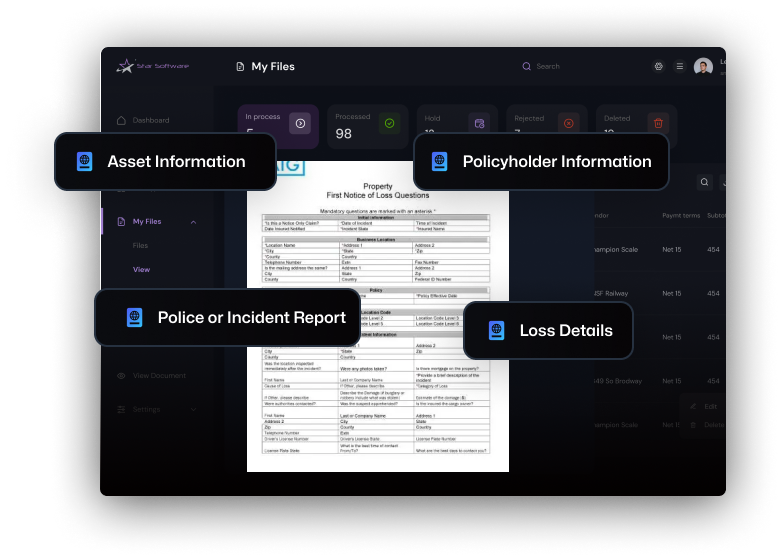

FNOL

Star Software introduces a revolutionary amalgamation of Optical Character Recognition (OCR) and Artificial Intelligence (AI), meticulously crafted to meet the distinctive needs of the insurance sector’s document management. This innovative solution marks the advent of a transformative era,pledging to redefine insurers’ approaches to document processing, verification, and fraud detection in a landscape where digital expertise is indispensable for staying ahead.