Last year, a mid-sized U.S.-based manufacturing firm narrowly avoided a six-figure fraud. A vendor had submitted an invoice with seemingly legitimate documents—logoed letterhead, itemized charges, and even a stamped delivery note. It wasn’t until their AI-powered accounts payable (AP) automation flagged inconsistencies in the image metadata that the finance team discovered the stamp and signature were AI-generated overlays. The company had almost paid a scammer.

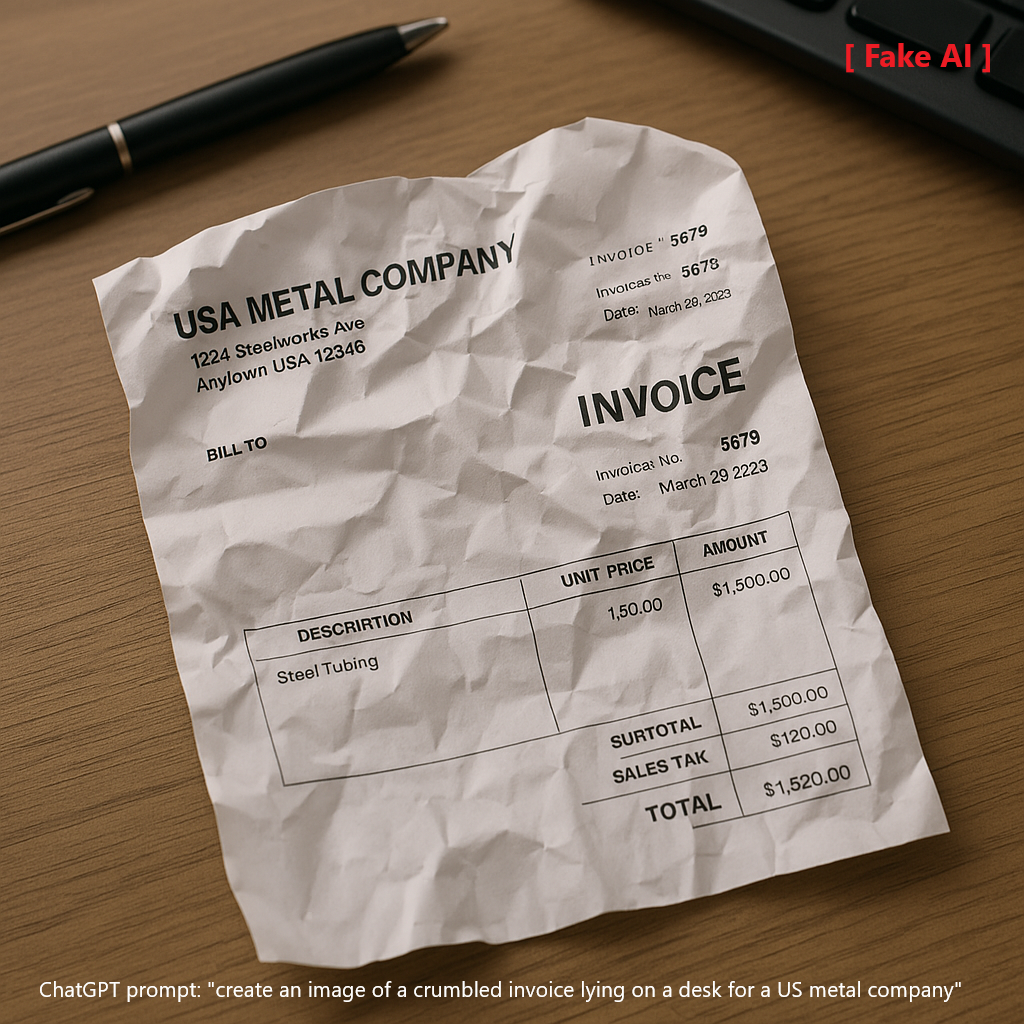

As generative AI becomes more sophisticated, fake images are starting to pass off as real, posing a new risk for corporate finance functions. And for AP teams dealing with dozens or hundreds of vendor invoices daily, this is no longer science fiction—it’s a growing operational threat.

The Rise of AI-Generated Image Fraud

AI tools like Midjourney, DALL·E, and Stable Diffusion are no longer just for artists and marketers. Fraudsters have begun using these platforms to forge documents with chilling accuracy. A vendor logo can be recreated in seconds, and fake delivery proofs or digitally signed receipts can be layered seamlessly over real backgrounds.

In some recent phishing cases, fake invoices were supported with doctored screenshots of bank transfers, or photoshopped GRNs (Goods Receipt Notes) from real suppliers—making it extremely difficult for the human eye to detect inconsistencies.

Why AP Teams Need to Worry

Traditionally, invoice verification has involved a mix of human checks and basic OCR tools. But when images appear authentic at first glance, and supporting documents are carefully tailored to match past transactions, a busy AP team may not catch the deception—especially under tight processing SLAs.

Beyond financial losses, approving a fraudulent invoice can damage vendor relationships, delay legitimate payments, and create compliance issues during audits.

How Smart AP Automation Can Help

Enter AI-powered AP automation systems—now equipped with intelligent image verification tools. These platforms don’t just read data; they analyze it.

Here’s how they fight AI-generated image fraud:

Logo and Signature Pattern Matching: Machine learning models trained on legitimate vendor documents can flag mismatches in logo shape, pixel density, or signature alignment—even if they look “right” to the human eye.

Cross-Referencing Historical Documents: Smart systems compare current documents against past verified submissions from the same vendor, flagging anomalies in stamp placement, color variations, or inconsistent formatting.

Metadata and Timestamp Validation: Image forensics can detect if an image has been altered, duplicated, or created using a generative model. For example, if an invoice claims to be from July but the image metadata says it was created in September, the system raises a red flag.

Source Verification: Some platforms now check if the logos or documents have been lifted from public sources (e.g., reverse-image searches) and warn against possible impersonation.

A Realistic Scenario

Let’s say a logistics vendor submits a $22,000 invoice with an attached delivery note showing a signature from the warehouse manager. Smart AP automation checks the document’s visual signature against its historical database and finds no match in the signature pattern. Simultaneously, the system notices the image was created using a known AI-generation tool, based on metadata fingerprints.

The invoice is paused, and the finance head is alerted. A quick call to the warehouse confirms that no such delivery took place. Fraud is averted.

The Human-AI Alliance

While smart AP automation can handle the first line of defense, fraud detection still benefits from human judgment. AI can flag suspicious documents, but the final verification often needs context—such as recent vendor behavior, ongoing disputes, or emergency procurement orders.

That’s why the future of fraud prevention in AP lies in a hybrid model: smart systems that do the heavy lifting, and informed finance professionals who make the final call.

——————————————————————————————————————-

Fake images are no longer limited to social media hoaxes—they’ve entered the world of business transactions. But while generative AI is giving fraudsters powerful tools, it’s also arming finance teams with sharper defenses.

Smart AP automation is not just a matter of efficiency anymore—it’s become a critical safeguard. Because in an age where fakes look real, the ability to detect the invisible could be the difference between profit and peril.