In the healthcare sector, accuracy, speed, and compliance are not just operational goals—they are regulatory imperatives. From managing vendor payments to maintaining proper audit trails, Accounts Payable (AP) is a critical function that directly impacts a provider’s financial health and legal standing.

As the healthcare industry becomes increasingly complex and regulated, manual AP processes are proving unsustainable. That’s why a growing number of hospitals, clinics, and pharmaceutical companies are embracing AP automation—not only to improve efficiency but also to ensure regulatory compliance at every step.

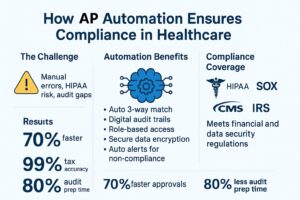

The Compliance Challenge in Healthcare AP

Healthcare organizations must adhere to a range of financial regulations and standards such as:

HIPAA (Health Insurance Portability and Accountability Act) for data privacy

SOX (Sarbanes-Oxley Act) for financial reporting integrity

CMS and Medicaid billing rules

IRS requirements for 1099 vendor reporting

Internal audit standards for fraud prevention

Manually processing invoices and payment approvals can lead to data entry errors, missed deadlines, duplicate payments, or worse—non-compliance that triggers audits or penalties.

How AP Automation Solves the Compliance Puzzle

1. Audit-Ready Digital Trails

AP automation platforms create timestamped, immutable records of every action—from invoice receipt to approval to payment. This ensures full audit traceability, a key requirement for SOX and HIPAA compliance.

2. Automated 3-Way Matching

By automatically matching invoices with purchase orders and goods received notes, automation reduces the risk of overpayment or fraudulent billing—strengthening internal controls and ensuring accurate reporting.

3. Data Encryption & Access Control

Modern AP solutions are built with enterprise-grade security, including role-based access and encryption, which aligns with HIPAA’s data protection mandates.

4. Regulatory Document Retention

Most healthcare regulations require financial records to be retained for several years. Automated systems digitally store and organize documents, making them easy to retrieve during inspections or audits.

5. Real-Time Compliance Alerts

Some platforms offer built-in alerts and AI-driven analytics to flag suspicious transactions, missing tax information, or expired vendor credentials—allowing compliance teams to act quickly.

Real-World Example: Hospital Network Case Study

A multi-location U.S. hospital group with over 800 vendors and 50,000 annual invoices faced recurring issues in invoice reconciliation and 1099 tracking. After implementing an AI-based AP automation solution:

Invoice approval time dropped by 70%

1099 error rates fell below 1%

Internal audit preparation time was reduced from weeks to days

The organization not only streamlined AP but also achieved a higher compliance rating in its next financial audit.

Bonus: Integration with ERP and EHR Systems

Many healthcare organizations operate on platforms like SAP, Oracle, or Epic. Modern AP automation tools offer seamless integration with these systems—ensuring that financial compliance is maintained across departments without duplication or data silos.

In a sector where regulatory scrutiny is high and error margins are thin, automating accounts payable is no longer optional—it’s essential. Healthcare companies that invest in AP automation not only gain efficiency and cost control but also build a robust compliance framework that can withstand audits, scale with growth, and ultimately, improve patient care by freeing up financial resources.