The insurance industry is built on trust, accuracy, and rigorous risk assessment. Yet, traditional onboarding processes for clients and vendors can be time-consuming and prone to errors, particularly when relying on manual methods to capture, verify, and analyze data. By integrating automation, insurance providers can achieve a more streamlined, efficient onboarding process that not only enhances accuracy but also strengthens security, reduces human error, and speeds up decision-making. Here’s how automation is transforming client and vendor onboarding for insurers.

1. Automated Data Capture: Reducing Processing Time and Improving Accuracy

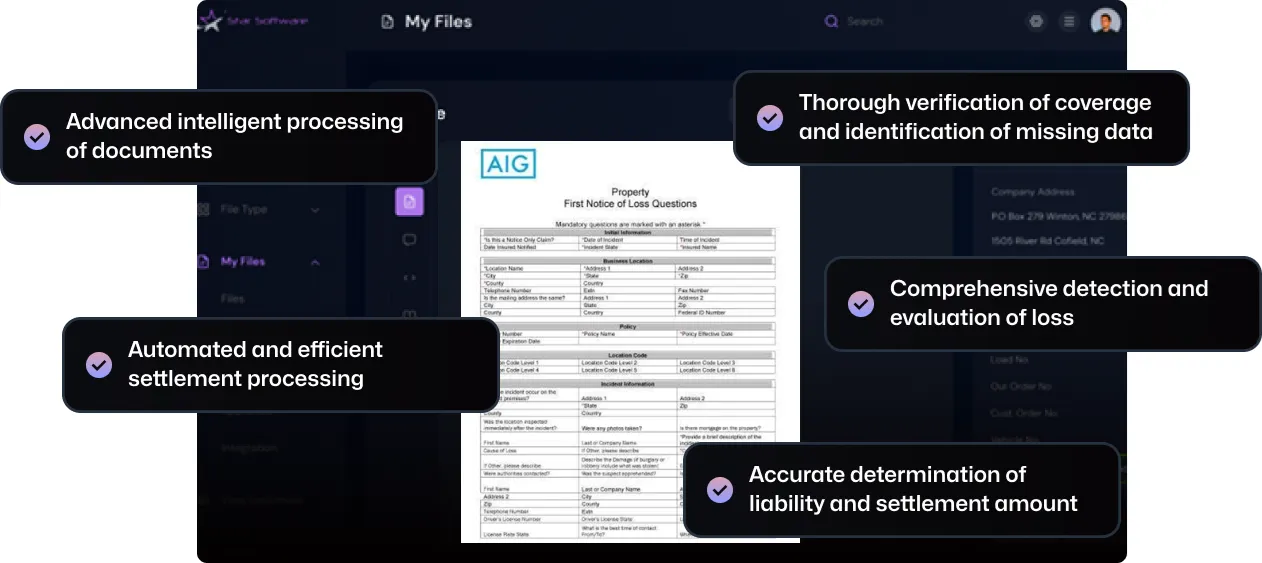

In the onboarding phase, insurance providers gather vast amounts of data from clients and vendors, such as contact details, identification numbers, financial information, and previous claims history. Manual data entry can slow down this process and increase the risk of errors. Automated data capture, however, allows insurance firms to extract information directly from emails, PDFs, and other sources, pulling in client data instantly and reducing manual workload.

For instance, Optical Character Recognition (OCR) technology can identify key fields like name, address, and contact details, allowing for seamless integration into databases. This not only expedites onboarding but ensures data accuracy, laying a strong foundation for client relationships.

2. Secure Handling of Sensitive Data: Protecting Client Trust

Insurance companies often handle highly sensitive information such as Social Security numbers, credit card details, and health information. Ensuring that this data is managed securely during onboarding is critical for maintaining compliance with regulatory standards like HIPAA and GDPR.

Automation can help by implementing algorithms that detect and mask sensitive fields automatically, safeguarding the information against unauthorized access. Automated systems can also flag sensitive data if it’s incomplete or incorrectly formatted, minimizing the risk of future compliance issues. This secure, compliant approach builds trust, reassuring clients and vendors alike.

3. Automated Follow-Up Workflows: Keeping the Process On Track

A major challenge in onboarding is maintaining consistent communication to ensure all required documents and information are gathered. Automated follow-up workflows help manage this process by notifying clients and relevant personnel of pending documentation or additional data needed.

For example, an automated email workflow could be set up to remind clients to submit specific documents or to verify personal details, reducing the need for manual follow-up and ensuring smoother onboarding. Such systems not only save time but also create a structured communication trail, which is essential in case of future audits.

4. Financial Health and Risk Assessment: Smart Decisions, Early Warnings

The financial stability of clients plays a crucial role in the insurance industry, particularly in underwriting and risk management. Automation can assist insurers by assessing a client’s financial health early on, even before a policy is issued. By automatically analyzing financial records such as bank statements or income data, insurers can determine the creditworthiness of clients, detect red flags, and set appropriate coverage limits.

Automated risk assessment tools can help establish thresholds for financial stability, credit risk, and potential fraud. For instance, if a client has a history of non-payment, automated systems can flag this as a potential risk, helping underwriters make better-informed decisions without exhaustive manual checks.

5. Benefits of Automation in Insurance Onboarding

Adopting automation in onboarding offers insurers a variety of strategic benefits:

- Enhanced Accuracy and Efficiency: Automated data capture reduces manual errors, ensuring a higher level of accuracy in client records.

- Stronger Data Security: Algorithms safeguard sensitive information, enhancing compliance with data protection regulations.

- Improved Client Experience: Faster, more efficient onboarding creates a positive initial impression, setting the stage for a strong client-insurer relationship.

- Effective Risk Management: Automation offers early detection of potential financial risks, aiding in smarter policy decisions and fraud prevention.

For insurers, automating the onboarding and verification process is not just about adopting new technology—it’s about enhancing accuracy, boosting security, and building trust with clients and vendors. As automation capabilities grow, insurance companies that embrace these tools will be better equipped to meet regulatory demands, manage risk effectively, and provide a more efficient, client-centered experience.

By transforming onboarding, insurers can reduce friction, increase transparency, and ultimately, strengthen the foundation of their business in an increasingly competitive industry landscape.