Blogs, News & Articles

The Smart Way to Scale PO & Invoice Processing

Finance departments don’t fail because of strategy. They fail quietly — under piles of invoices, mismatched purchase orders, delayed approvals, and audit pressure. While ERP systems promise control, the reality is that documents still arrive unstructured, fragmented across emails, portals, PDFs, and scans.

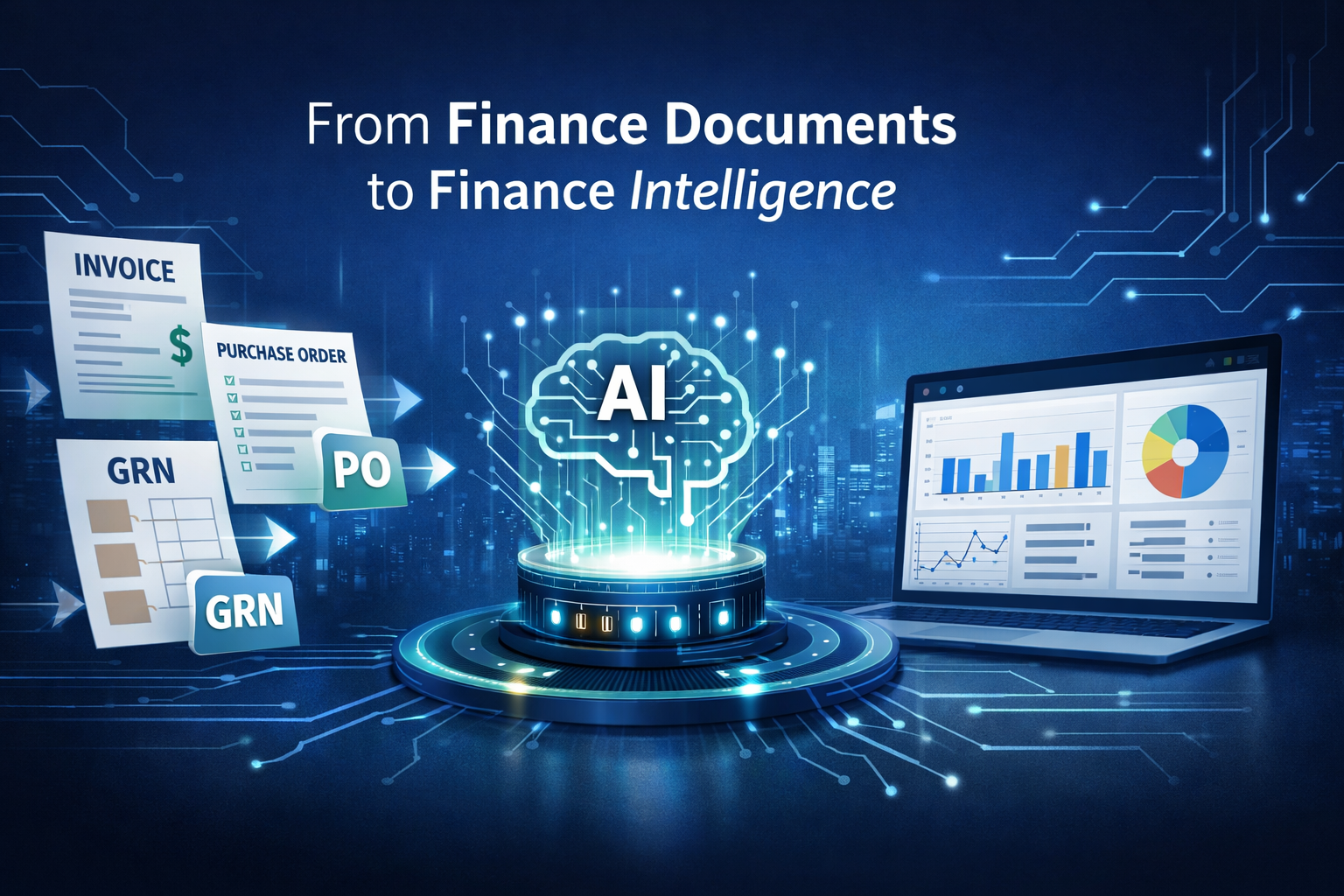

That gap between documents and systems is where Intelligent Document Processing (IDP) has become indispensable.

Why Finance Teams Are Rethinking Document Processing

A typical mid-to-large finance team processes:

Thousands of POs across vendors and geographies

Multiple invoice formats for the same supplier

Manual exceptions during 2-way and 3-way matching

Last-minute firefighting before month-end close

Traditional OCR reads text. Finance teams need systems that understand financial intent.

That’s the difference IDP brings.

What IDP Really Means for Finance (Beyond OCR)

IDP combines:

Advanced OCR

Machine learning models trained on finance documents

Business rule validation

ERP integrations

Instead of just extracting data, IDP:

Understands relationships between documents

Flags anomalies proactively

Learns from historical corrections

Think of it as a digital AP analyst that improves with every invoice processed.

-------------------------------------------------------------------------------------------------------------------------

Finance Documents IDP Processes — With Real-World Examples (US, Europe & MENA)

1. Purchase Orders (POs)

US Manufacturing Example

A Midwest-based automotive components manufacturer processed 18,000+ POs annually. Supplier-specific layouts caused frequent mismatches during invoicing, delaying payments by weeks.MENA Manufacturing & EPC Example (UAE / Saudi Arabia)

A large EPC contractor in the GCC handled POs across multiple subsidiaries and vendors in UAE, Saudi Arabia, and Qatar. POs arrived in English and Arabic, often as scanned PDFs, leading to approval delays and downstream invoice disputes.With IDP

PO numbers, line items, tax codes (VAT), delivery terms auto-extracted

Validation against ERP and contract master data

Exceptions flagged before invoices arrived

Impact

PO mismatch errors reduced by ~70%

Invoice approval cycle shortened by ~30%

Faster vendor settlements across regions

2. Accounts Payable Invoices

Global Retail Chain (US + Europe)

Invoices from 40+ countries, multiple currencies, languages, and tax regimes caused duplicate payments and audit queries.MENA Retail & Hospitality Group

A regional retail and hospitality group in UAE and Saudi Arabia processed high invoice volumes from local and international vendors. Manual entry struggled with VAT compliance, currency conversions, and duplicate submissions.With IDP

Header and line-level invoice data auto-extracted

2-way and 3-way matching in real time

Duplicate invoices detected using pattern recognition

Impact

Invoice processing time reduced from days to hours

Duplicate payment risk significantly lowered

Predictable month-end close, even during peak seasons

3. Goods Receipt Notes (GRNs) & Delivery Documents

US Metals & Industrial Supplier

Frequent mismatches between delivered quantities and invoiced amounts during demand surges.MENA Metals, Oil & Gas Supplier

A Saudi-based metals and industrial supplier faced discrepancies between delivery challans, GRNs, and supplier invoices, especially for cross-border shipments.With IDP

GRNs and delivery documents digitized

Automatic matching with POs and invoices

Quantity and pricing discrepancies flagged instantly

Impact

Overbilling incidents sharply reduced

Early visibility into liabilities and inventory exposure

Stronger coordination between stores, procurement, and finance

4. Credit Notes & Adjustments

Global Pharma Distributor

Missed or delayed credit notes caused overstated payables and reconciliation issues.MENA Pharma & Healthcare Distributor

High volume of rebates, returns, and pricing adjustments led to frequent reconciliation gaps and audit observations.With IDP

Credit notes automatically linked to original invoices

Adjustments validated before ledger posting

Impact

Cleaner reconciliations

Fewer audit observations

Accurate payable positions across entities

----------------------------------------------------------------------------------------------------------------------

What Finance Leaders Actually Gain from IDP

IDP delivers more than operational efficiency:

Faster AP cycles without adding headcount

Improved cash flow visibility

Audit-ready documentation trails

Better vendor relationships through timely payments

Scalability during seasonal or demand spikes

Most importantly, finance teams shift from data correction to financial insight.

From Document Processing to Finance Intelligence

For CFOs, IDP is not another automation experiment. It is a foundational capability — enabling ERP systems to function as intended, while freeing finance professionals to focus on governance, forecasting, and strategy.

In an environment where every delayed invoice impacts cash flow and credibility, IDP becomes the silent engine of a high-performing finance organization.

Common Purchase Order Errors That Can Cost Enterprises Millions

Purchase Orders are often treated as routine operational documents. In reality, they are financial control instruments. Even small errors in a PO can cascade into invoice disputes, delayed deliveries, compliance issues, and revenue leakage—sometimes costing enterprises millions annually.

As procurement volumes grow and supplier networks expand, manual PO processing becomes a hidden risk. Below are the most common and costly PO errors organizations face—and how intelligent automation changes the equation.

Incorrect or Missing PO Numbers

A missing or incorrect PO number may seem minor, but it can derail the entire procure-to-pay cycle. In many organizations, invoices without valid PO references are automatically rejected, leading to payment delays, strained supplier relationships, and operational backlogs.

Financial impact:

Delayed payments, missed early-payment discounts, supplier penalties, and reprocessing costs.How Star Software helps:

Star’s Intelligent Document Processing (IDP) automatically identifies and validates PO numbers during ingestion, ensuring consistency across documents and ERP systems before downstream processing begins.Item Description and Line-Item Mismatches

Manual entry often leads to mismatches between item descriptions in the PO and those in the ERP or invoice. These discrepancies trigger three-way match failures and manual reviews.

Financial impact:

Invoice holds, delayed production schedules, inventory imbalances, and increased working capital lock-up.How Star Software helps:

Star’s automation extracts line-item data contextually—not just text—ensuring accurate mapping of item descriptions, quantities, and units of measure directly into ERP systems.Pricing and Quantity Errors

Overstated quantities or incorrect unit pricing are among the most expensive PO errors. These mistakes frequently go unnoticed until audits or supplier reconciliations uncover them—often too late to recover losses.

Financial impact:

Overpayments, margin erosion, audit exposure, and compliance risks.How Star Software helps:

Star’s IDP validates pricing and quantity fields against predefined business rules and master data, flagging anomalies automatically before they reach the ERP or payment stage.Tax, Freight, and Additional Charge Errors

Taxes, freight charges, and surcharges are commonly misapplied or omitted during manual PO creation. These errors complicate invoice reconciliation and regulatory reporting.

Financial impact:

Regulatory penalties, incorrect tax filings, and revenue leakage across high transaction volumes.How Star Software helps:

Automation ensures structured extraction and validation of tax and ancillary charges, improving compliance and reducing reconciliation effort.Vendor and Delivery Detail Inaccuracies

Incorrect vendor IDs, delivery locations, or payment terms can result in shipments going to the wrong destination or invoices being posted against the wrong supplier account.

Financial impact:

Logistics costs, delayed deliveries, contractual disputes, and operational inefficiencies.How Star Software helps:

Star’s automation cross-verifies vendor and delivery details against ERP master data, reducing dependency on manual checks and institutional knowledge.The Cumulative Cost of Manual Errors

Individually, PO errors may appear manageable. At scale, however, they create a systemic financial drain—through rework, delays, disputes, and lost trust. Enterprises processing thousands of POs monthly often underestimate how quickly these costs add up.

How Star Software’s Automation Changes the Risk Profile

Star Software’s Intelligent Document Processing transforms PO handling from a reactive, error-prone process into a controlled, automated workflow. By combining AI-driven extraction, business-rule validation, and seamless ERP integration, Star ensures that only accurate, compliant data enters core systems.

The result is not just efficiency—but financial risk reduction at scale.

Purchase Order errors are not operational inconveniences; they are financial liabilities. As transaction volumes grow, relying on manual processes becomes increasingly expensive and risky.

By automating PO processing, validation, and ERP integration, Star Software helps enterprises prevent costly errors before they occur—protecting margins, improving compliance, and enabling scalable growth.

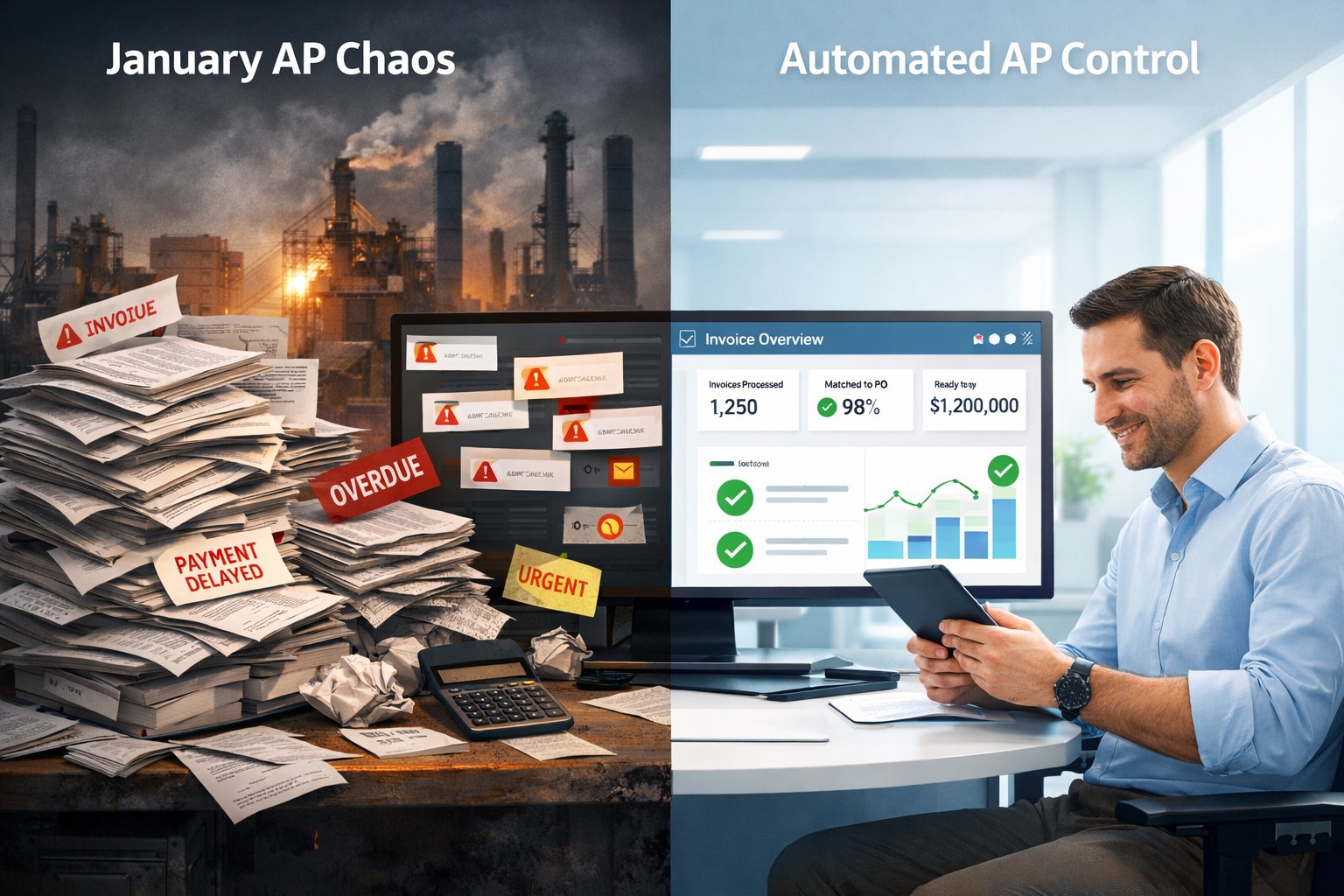

Why January Breaks Accounts Payable in the Metal Industry

For most industries, January marks a fresh start. For Accounts Payable (AP) teams in the metal sector, it often marks the most stressful month of the year.

As steel mills, service centers, aluminum producers, and metal processors reopen after year-end shutdowns, AP departments are hit by a perfect storm—invoice backlogs, supplier pressure, compliance risks, and audit deadlines. What looks like a routine month on the calendar quickly turns into a firefighting exercise.

The January Backlog Nobody Plans For

By the time plants resume full operations in early January, AP teams are already weeks behind.

Invoices raised in late December pile up due to holiday closures, reduced staffing, and deferred approvals. In the metal industry—where high-volume, high-value transactions are the norm—even a few days’ delay can trigger supplier escalations.

Manual AP processes struggle to cope with:

Hundreds of pending invoices arriving at once

Missing or incomplete Purchase Order (PO) references

Mismatches between PO, GRN, and invoice data

Urgent requests from production teams to unblock supplies

January doesn’t create the problem—it exposes existing inefficiencies.

Year-End Compliance Meets New-Year Chaos

January is also when finance teams must close the books, reconcile balances, and prepare for audits. In metal manufacturing, this becomes even more complex due to:

Multi-line invoices with complex pricing structures

Freight, fuel surcharges, and alloy-based price variations

Vendor-specific formats with inconsistent data placement

AP teams often end up spending hours validating invoices manually—just to ensure compliance. Any error discovered during audits can lead to rework, delayed reporting, or worse, regulatory scrutiny.

Supplier Relationships Take the First Hit

Suppliers in the metal ecosystem—logistics providers, scrap dealers, raw material vendors—operate on tight cash cycles. January delays in payments can strain relationships built over years.

Common fallout includes:

Increased follow-ups and dispute emails

Temporary supply holds

Loss of early payment discounts

Escalations to procurement leadership

What starts as an AP bottleneck quickly becomes a business risk.

Why Manual AP Breaks Down in January

Most AP teams rely heavily on spreadsheets, email-based approvals, and manual data entry. While these systems may limp along during normal months, January volumes overwhelm them.

Manual processes fail because they:

Can’t scale with sudden invoice surges

Depend on key individuals who may be unavailable

Lack visibility into invoice status and exceptions

Create silos between AP, procurement, and operations

In the metal sector, where margins are sensitive and timelines critical, this breakdown is costly.

How Leading Metal Companies Are Fixing January AP Stress

Forward-looking metal companies are rethinking AP not as a back-office function, but as a critical operational enabler.

1. Automating Invoice Ingestion with AI

AI-powered Intelligent Document Processing (IDP) systems can extract data from invoices—regardless of format—within seconds. This eliminates January’s biggest bottleneck: manual data entry.

2. Enforcing Touchless PO Matching

Automated 2-way and 3-way matching ensures invoices are validated against POs and GRNs instantly. Exceptions are flagged early, not discovered weeks later.

3. Real-Time Visibility for Finance and Procurement

Dashboards provide instant insights into pending invoices, approvals, and payment timelines—allowing teams to prioritize critical suppliers and avoid escalations.

4. Faster Closures, Cleaner Audits

Digitally captured, validated invoice data ensures audit readiness from day one. January no longer becomes a scramble to justify numbers.

5. Stronger Supplier Confidence

When suppliers receive timely payments—even during peak January volumes—it builds trust and ensures uninterrupted material flow.

January Doesn’t Have to Be the Hardest Month

The truth is, January is only difficult for AP teams relying on outdated processes. For organizations that embrace AP automation, it becomes just another month—predictable, controlled, and efficient.

In the metal sector, where supply continuity and financial discipline go hand in hand, modernizing Accounts Payable isn’t a convenience. It’s a necessity.

Fix the process, and January fixes itself.

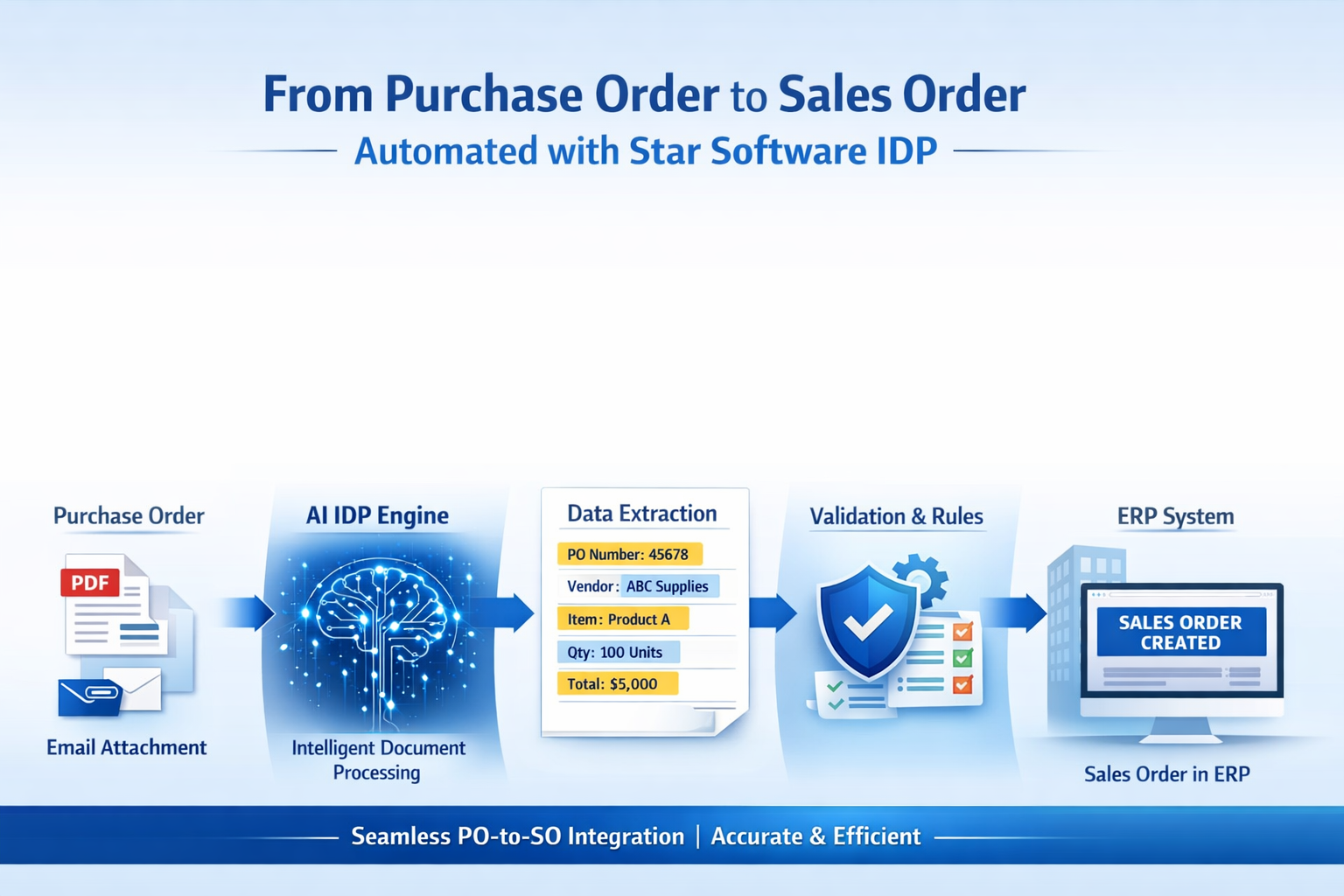

From Purchase Order to Sales Order: How Star Software’s IDP Eliminates Manual ERP Entry

Order intake remains a critical yet error-prone function for many enterprises. Purchase Orders (POs) arrive in varied formats—PDFs, scanned documents, and email attachments—often requiring manual data entry before they can be converted into Sales Orders (SOs) in ERP systems. This manual intervention not only slows down order processing but also introduces inaccuracies that impact fulfillment and revenue cycles.

Star Software addresses this challenge through its Intelligent Document Processing (IDP) capabilities, enabling seamless automation from PO receipt to SO creation within ERP systems.

The Challenge with Manual PO Processing

Traditional OCR-based solutions can extract text, but they lack the contextual understanding required for business documents like POs. Line items, quantities, pricing, taxes, and delivery terms often require manual verification and correction. As order volumes increase, this dependency on human effort becomes a scalability bottleneck, leading to delayed order confirmations and inconsistent ERP data.

How Star Software’s IDP Transforms PO Processing

Star Software’s IDP solution goes beyond basic text recognition by applying AI-driven document classification and contextual data extraction. Incoming POs are automatically identified, regardless of layout or vendor format. The system extracts critical fields such as PO number, vendor details, item descriptions, quantities, pricing, taxes, and delivery dates with high accuracy.

Once extracted, the data is validated against predefined business rules and master data. Any exceptions are flagged intelligently, while compliant data flows through without human intervention.

Seamless PO-to-SO Integration with ERP Systems

After validation, the structured PO data is directly mapped to corresponding Sales Order fields in the ERP. This enables automatic SO creation without manual re-entry. The integration ensures data consistency across systems while significantly reducing processing time.

By automating this handoff between documents and ERP workflows, organizations eliminate repetitive tasks and reduce the risk of downstream errors.

Business Impact and Measurable Outcomes

Organizations using Star Software’s IDP for PO-to-SO automation benefit from substantial operational improvements. Manual order entry is reduced by up to 80–90%, order processing cycles are accelerated, and data accuracy improves significantly. Teams can handle higher order volumes without additional staffing, while customers benefit from faster order confirmations and improved service levels.

Enabling Scalable and Resilient Order Operations

As enterprises scale, order intake processes must keep pace with growing complexity and volume. Star Software’s Intelligent Document Processing ensures that order management workflows remain fast, accurate, and resilient—turning document-heavy processes into streamlined, automated operations.

By automating the journey from Purchase Order to Sales Order, Star Software helps organizations unlock efficiency, improve ERP data quality, and accelerate revenue realization.

How AI Is Changing QA Leadership in Manufacturing

For decades, “quality” in manufacturing was defined by inspection outcomes—pass or fail, compliant or non-compliant. In 2026, that definition no longer holds. As AI-driven systems reshape production, supply chains, and compliance expectations, Quality Assurance (QA) leaders are redefining quality as control, predictability, and evidence integrity.

This shift is not driven by technology enthusiasm, but by operational reality.

From Inspection to Intelligence

Traditional QA focused on detecting defects after they occurred. AI-enabled manufacturing flips this model. Today’s QA leaders prioritize early detection, pattern recognition, and predictive risk signals.

AI-powered QA systems analyze inspection data, supplier certificates, machine outputs, and historical deviations to identify trends long before failures surface. Quality is no longer a checkpoint—it is a continuous intelligence layer embedded into operations.

Quality as Evidence, Not Documentation

In 2026, auditors and regulators care less about whether documents exist and more about whether evidence is governed. QA leaders are redefining quality around data integrity, traceability, and audit defensibility.

AI-driven QA automation ensures:

Every quality record is traceable to source

Every decision has a system-backed rationale

Every approval is logged, versioned, and immutable

Quality is no longer “managed” in inboxes and spreadsheets—it is controlled within systems.

Supplier Quality Moves to the Center

As manufacturing ecosystems expand globally, QA leaders are shifting focus upstream. Supplier-generated data—COAs, MTRs, inspection reports—represents the largest quality risk surface.

AI helps QA teams:

Detect recurring supplier deviations

Flag inconsistent formatting or missing data

Score suppliers based on quality reliability, not just cost

In 2026, supplier quality is no longer reactive firefighting. It is a measurable, automated control mechanism.

Speed Without Compromising Control

One misconception about AI in QA is that it prioritizes speed over rigor. In practice, the opposite is true. QA leaders are leveraging AI to standardize decision-making, reduce manual intervention, and eliminate subjective judgments.

Automation enables faster approvals—but within clearly defined rules, thresholds, and compliance frameworks. Quality improves not because teams move faster, but because systems remove variability.

Quality as a Business Enabler

Perhaps the most significant redefinition is organizational. QA leaders in 2026 are no longer seen as gatekeepers slowing production. They are risk managers enabling scale.

AI-driven quality systems help organizations:

Accelerate supplier onboarding

Reduce audit observations

Prevent shipment delays

Protect revenue during demand surges

Quality becomes a strategic asset—not a compliance burden.

The New Definition of Quality in 2026

For QA leaders, quality in an AI-driven manufacturing era means:

Predictive, not reactive

System-governed, not person-dependent

Evidence-driven, not document-heavy

Embedded into operations, not layered on top

In 2026, quality is no longer about catching errors.

It is about proving control—at scale.