Blogs, News & Articles

Top 10 MTR Automation Metrics That Matter to Quality Heads in 2026

For Quality Heads, Mill Test Report (MTR) automation is no longer judged by how many PDFs were processed. In 2026, its value is measured by how well it protects audit outcomes, supplier integrity, and production continuity. As regulatory scrutiny tightens and supply chains stretch across borders, Quality leaders are redefining success through metrics that demonstrate control—not activity.

Below are the ten MTR automation metrics that truly matter to Quality Heads in 2026.

1. MTR First-Pass Validation Rate

This metric measures the percentage of incoming MTRs that pass specification, heat number, and chemistry checks without manual intervention. A high first-pass rate signals that automation logic is mature and supplier data quality is stable. Quality Heads track this closely because it directly reflects how often QA teams are forced into exception handling.

2. Specification Match Accuracy

Beyond data extraction accuracy, this metric evaluates how reliably MTR values align with ASTM, ASME, or customer-specific material specifications. In 2026, auditors increasingly test whether systems can automatically flag borderline or out-of-range values. Quality leaders see this as a proxy for audit defensibility.

3. Exception Resolution Turnaround Time

When MTR discrepancies occur, the speed at which they are resolved determines whether production halts or continues. This metric tracks the time from exception detection to final disposition. In high-volume environments, even small delays compound into shipment risks—making this a board-level concern in regulated industries.

4. Supplier MTR Error Rate

Quality Heads are shifting focus from internal QA performance to upstream supplier behavior. This metric identifies suppliers with recurring MTR inconsistencies, missing fields, or formatting anomalies. In 2026, it is increasingly used to drive supplier scorecards and corrective action programs.

5. Audit Traceability Coverage

This measures the percentage of MTRs that are fully traceable—linked to purchase orders, heat numbers, production lots, and shipments. During audits, partial traceability is often worse than failure. Quality leaders value this metric because it demonstrates system-level governance, not individual diligence.

6. Manual Touchpoint Reduction Rate

Manual handling introduces risk, variability, and undocumented decision-making. This metric tracks how much human intervention has been eliminated from MTR processing workflows. In 2026, Quality Heads correlate this directly with reduced audit findings and improved data integrity.

7. MTR Processing Cycle Time

From receipt to approval, cycle time reflects how well automation integrates with ERP, QMS, and supplier portals. Faster cycles improve production planning and supplier onboarding, but Quality leaders focus on consistency—not just speed—to ensure controls are not bypassed.

8. Data Integrity Violation Incidents

This metric captures instances of altered files, overwritten values, missing version histories, or broken approval chains. With regulators emphasizing data integrity across industries, Quality Heads treat this as a non-negotiable metric tied to enterprise risk management.

9. Compliance Rule Coverage Ratio

Not all automation platforms enforce the same depth of rules. This metric evaluates how many applicable standards—ASTM, ISO, AS9100, IATF, customer specs—are actively governed by the system. In 2026, Quality leaders expect automation to adapt as regulations evolve, not require reconfiguration projects.

10. Audit Observation Rate Linked to MTRs

Ultimately, Quality automation is judged in the audit room. This metric tracks how often MTR-related issues appear in internal or external audit observations. A declining trend is the strongest signal that MTR automation is functioning as a quality evidence control—not a document handling tool.

Why These Metrics Redefine Quality Leadership in 2026

Quality Heads are no longer evaluated on inspection rigor alone. They are accountable for evidence governance, supplier reliability, and audit resilience. MTR automation, when measured correctly, becomes a strategic control layer—reducing risk before it reaches production or regulators.

In 2026, the question is no longer “Do we automate MTRs?”

It is “Can we prove our quality system is in control—at scale?”

Why Faster COA Turnaround Improves Customer Onboarding and Retention

In many regulated industries, customer onboarding does not begin with a sales order—it begins with documentation. Certificates of Analysis (COAs) are often the final gatekeepers before materials are approved, shipments are released, and trust is formally established. When COA turnaround is slow, onboarding stalls. When it is fast, accurate, and reliable, customer relationships accelerate.

This is no longer a quality-side concern alone. COA speed now directly influences revenue realization, customer experience, and long-term retention.

COA Turnaround: The Hidden Onboarding Bottleneck

For manufacturers and suppliers in pharma, chemicals, food, and metals, new customers typically require COAs to be reviewed and approved before accepting the first shipment. In theory, this is a simple compliance step. In practice, it often becomes a delay-prone loop involving PDFs, emails, manual checks, and rework.

Every hour spent validating a COA is an hour the customer waits to proceed with production, testing, or resale. From the customer’s perspective, slow COA turnaround signals operational friction—even if product quality itself is not in question.

Over time, these early frictions shape perception. A supplier that struggles to deliver compliant documentation on time is seen as risky, regardless of price or product performance.

Onboarding is fundamentally about trust. Customers want assurance that materials meet specifications, that data is accurate, and that compliance will not become a recurring issue.

When COAs are processed quickly and consistently, it sends a clear signal:

The supplier understands regulatory expectations

Documentation is treated as a controlled, governed process

Quality data can be relied upon without constant follow-up

This confidence matters most at the beginning of the relationship. A smooth first onboarding experience reduces the need for escalations, repeated clarifications, and manual audits later on.

In contrast, delayed or error-prone COAs create doubt early—doubt that is difficult to reverse.

Speed Reduces Friction Across the Customer Lifecycle

COA turnaround does not stop mattering after onboarding. It affects every repeat order, every batch release, and every audit interaction.

Faster COA processing enables:

Quicker material acceptance at customer facilities

Reduced holds in inbound quality inspection

Faster release to production or distribution

Lower dependency on customer-side manual verification

Customers remember suppliers who “just work.” Over time, those suppliers face fewer disputes, fewer urgent follow-ups, and fewer demands for redundant checks.

Retention, in this context, is not driven by loyalty programs or contracts—it is driven by operational ease.

Automation Changes the Economics of COA Speed

Manual COA review does not scale. As customer volume grows, so does document complexity—different formats, test parameters, units, and regulatory requirements. Human review becomes slower, not faster.

Automation changes this dynamic by:

Extracting and validating COA data instantly

Applying specification rules consistently

Flagging exceptions instead of reviewing everything

Creating traceable, audit-ready records

This allows suppliers to maintain fast turnaround even as onboarding volumes increase. Speed becomes a repeatable capability, not a function of individual effort.

From the customer’s point of view, the experience remains the same: predictable, reliable, and friction-free.

Faster COAs Directly Influence Retention Decisions

Retention decisions are rarely dramatic. Customers do not usually leave because of one failure—they leave because of repeated small inefficiencies.

Slow COA turnaround contributes to:

Production delays

Increased internal review costs

Compliance anxiety during audits

Preference for alternative suppliers who respond faster

Conversely, suppliers who consistently deliver fast, accurate COAs become the default choice. Procurement teams may renegotiate pricing, but operations teams quietly advocate to keep suppliers who do not disrupt workflows.

In regulated industries, reliability outweighs marginal cost differences.

From Compliance Task to Customer Experience Lever

Faster COA turnaround:

Shortens time-to-first-revenue

Improves first impressions with new customers

Reduces churn caused by operational frustration

Strengthens long-term supplier credibility

In an environment where products are increasingly commoditized, experience becomes the differentiator. And in regulated supply chains, experience begins with how well quality evidence is delivered.

How AR Automation Protects Cash Flow During Demand Slowdowns in the U.S. Metals Market

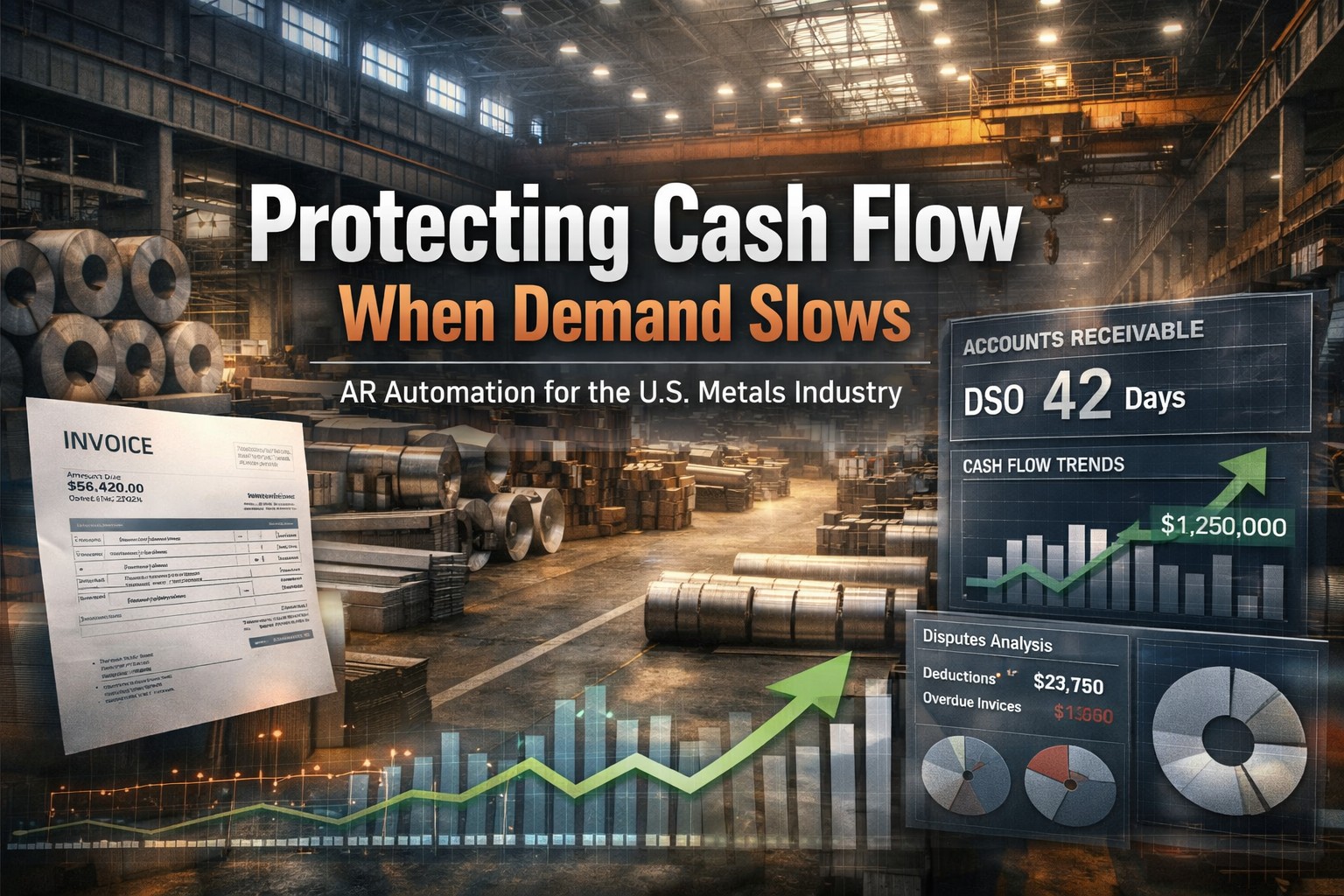

Demand cycles in the U.S. metals market are unforgiving. When construction pauses, automotive orders soften, or infrastructure projects slow, the impact is felt immediately—not just on order books, but on cash flow. During these periods, the weakest link is rarely sales. It is Accounts Receivable.

For many U.S. metal manufacturers and service centers, AR processes are still heavily manual—dependent on spreadsheets, emails, and fragmented ERP workflows. In a slowdown, this model quietly amplifies risk.

When Demand Slows, Cash Discipline Matters More Than Revenue

In high-demand cycles, delayed invoices, unresolved disputes, and slow collections are often masked by volume. Cash keeps coming in despite inefficiencies. But when demand tightens, every unpaid invoice becomes visible on the balance sheet.

Metal companies face unique AR challenges:

Pricing tied to weight, grade, and heat numbers

Frequent freight and fuel surcharges

Short pays due to specification or documentation mismatches

High dispute volumes from OEMs and distributors

During slowdowns, customers become more aggressive in scrutinizing invoices. Minor discrepancies that once passed now trigger payment holds. Manual AR teams struggle to keep up.

AR Automation Shifts AR from Reactive to Preventive

AR automation fundamentally changes how cash is protected—not by chasing payments harder, but by preventing delays in the first place.

Automated AR systems ensure invoices are:

Generated faster after shipment

Matched automatically with POs, BOLs, contracts, and quality documents

Validated for pricing, freight, and quantity accuracy before dispatch

This reduces the number of “defective invoices” entering the customer’s AP system—one of the biggest causes of delayed payments in the metals sector.

Faster Dispute Resolution Preserves Liquidity

In downturns, unresolved disputes become cash traps. A single pricing or freight discrepancy can hold up hundreds of thousands of dollars.

AR automation enables:

Automated identification of short pays and deductions

Categorization of disputes by root cause (price variance, freight, quality, quantity)

Faster collaboration between finance, sales, logistics, and quality teams

Instead of disputes sitting in inboxes for weeks, they move through structured workflows with accountability and visibility.

Real-Time DSO Visibility Enables Early Intervention

During demand slowdowns, Days Sales Outstanding (DSO) is one of the earliest indicators of financial stress.

Manual AR reporting often lags reality. By the time DSO deterioration is visible, cash gaps have already formed.

AR automation provides:

Real-time DSO tracking by customer, region, and product line

Early warning signals on customers extending payment behavior

Data-backed prioritization of collection efforts

This allows finance leaders to intervene before payment delays become systemic.

Protecting Cash Without Damaging Customer Relationships

Aggressive collections during downturns can strain long-term customer relationships—especially in the tightly networked U.S. metals ecosystem.

Automation enables a more professional, data-driven approach:

Accurate invoices reduce friction

Clear documentation speeds approvals on the customer side

Structured communication replaces ad-hoc follow-ups

Customers pay faster not because they are pressured—but because it is easier to pay correctly.

AR Automation as a Downcycle Survival Tool

Historically, metal companies that survive downturns are not always the ones with the strongest order books—but the ones with the tightest cash control.

AR automation helps organizations:

Stabilize cash inflows during demand volatility

Reduce dependency on credit lines

Improve forecasting accuracy for leadership decisions

In slow markets, protecting cash is protecting the business.

--------------------------------------------------------------------

Demand slowdowns in the U.S. metals market are inevitable. Cash flow crises don’t have to be.

AR automation transforms Accounts Receivable from a back-office function into a frontline defense—ensuring that even when volumes decline, liquidity remains predictable, controlled, and resilient.

Because in metals, surviving the cycle is as important as winning the next one.

Audit-Ready COA & MTR Management: A QA Specialist’s Guide

Quality audits rarely fail because of product defects alone. In most regulated industries, documentation gaps—especially around Certificates of Analysis (COAs) and Mill Test Reports (MTRs)—are what trigger non-conformances, observations, and warning letters.

For QA specialists, COA and MTR management has evolved from a clerical task into a high-risk quality function. Auditors across FDA, ISO 9001, AS9100, and IATF increasingly evaluate how well organizations control, validate, and trace supplier-provided quality data.

This guide explains what auditors expect today, supported by data points and real-world QA use cases.

Why COA & MTR Systems Are Under Audit Scrutiny

According to FDA enforcement trends and ISO audit reports, documentation-related deficiencies account for 30–40% of audit observations in regulated manufacturing environments. A significant share of these involve:

Incomplete or inconsistent supplier certificates

Manual transcription errors

Poor traceability between material, certificate, and production batch

Auditors no longer ask, “Do you have the COA?”

They ask, “Can you prove this COA was reviewed, verified, approved, and applied correctly?”FDA: Data Integrity and Controlled Review

For FDA-regulated industries (pharma, biotech, medical devices), COAs fall squarely under data integrity requirements.

What FDA Auditors Verify

Document authenticity: COAs must be original, complete, and attributable to verified suppliers.

Controlled QA review: Named reviewers, date/time stamps, and documented approval workflows.

ALCOA+ compliance: Data must be accurate, complete, consistent, and enduring.

Electronic controls: Audit trails, role-based access, and change history for digitized COAs.

Real QA Use Case

A mid-sized pharmaceutical manufacturer received an FDA 483 because QA staff manually copied assay values from supplier COAs into a LIMS system. A single transcription error went undetected and impacted multiple batches.

Root cause: No system-level validation between COA values and specification limits.Lesson for QA: Manual re-entry of COA data is now treated as a data integrity risk, not a minor inefficiency.

ISO 9001: Process Consistency Over Individual Judgment

ISO 9001 auditors focus less on regulation and more on repeatable, controlled processes.

What ISO Auditors Expect

Documented procedures for COA/MTR receipt, review, and acceptance

Defined acceptance criteria linked to specifications

Risk-based differentiation (critical vs non-critical materials)

Fast retrieval of historical records during audits

Data Insight

ISO audit bodies report that inconsistent QA review practices across sites are among the top causes of minor and major non-conformances.

Real QA Use Case

A global chemicals company passed audits at one plant but failed at another. Investigation showed each site used different informal rules to review COAs.

Result: Non-conformance due to lack of standardized control.Lesson for QA: Auditors assess the system, not individual competence.

AS9100: Traceability Is Binary—You Have It or You Don’t

In aerospace and defense, AS9100 audits are uncompromising. A missing link in traceability can invalidate entire material lots.

What AS9100 Auditors Check

End-to-end traceability: supplier → heat/batch → part → delivery

Alignment with current engineering specifications

Long-term document retention (often decades)

Controls against counterfeit or altered certificates

Real QA Use Case

An aerospace supplier failed an AS9100 audit when auditors found that heat numbers on MTRs were not digitally linked to finished parts. QA relied on spreadsheet cross-references.

Impact: Immediate suspension of approvals until corrective actions were implemented.Lesson for QA: Manual traceability methods do not scale—and auditors know it.

IATF 16949: COAs as Tools for Defect Prevention

IATF auditors view COAs and MTRs as active quality inputs, not passive records.

What IATF Auditors Expect

Integration with incoming inspection decisions

Defined reaction plans for missing or non-conforming COAs

Supplier performance tracking using COA deviations

Standardized rules across plants and programs

Industry Data

Automotive OEMs report that supplier documentation errors contribute to up to 20% of incoming material holds, delaying production and increasing cost.

Real QA Use Case

A Tier-1 automotive supplier repeatedly accepted late COAs without escalation. During audit, QA could not show corrective actions linked to recurring documentation issues.

Finding: Failure to use COA data for supplier quality improvement.Lesson for QA: Reviewing a COA is not enough—acting on its data is mandatory.

Common Audit Findings Across All Standards

Regardless of framework, auditors consistently flag:

Manual data transcription without validation

Missing or undocumented QA approvals

Poor linkage between certificates and material lots

Outdated specifications used during review

Inability to retrieve documents quickly during audits

Organizations that rely on emails, shared drives, or PDFs alone are increasingly exposed.

What Audit-Ready COA & MTR Systems Look Like

Audit-ready QA teams typically operate with:

Structured extraction of COA/MTR data (not free-text PDFs)

Rule-based validation against specs and tolerances

Role-based review and approval workflows

Full traceability across suppliers, lots, and batches

Searchable, audit-ready repositories retrievable in minutes

Even when automation is not explicitly required by regulation, auditors now expect digital control and evidence.

Final Perspective for QA Specialists

COA and MTR management is no longer a back-office activity. It is a front-line quality risk function with direct impact on compliance, recalls, and customer trust.

QA teams that treat certificates as static documents often discover gaps during audits. Those that treat them as controlled quality data are consistently audit-ready.

Why Manufacturers Need Integrated COA and MTR Automation

In several regulated and precision-driven industries—such as aerospace alloys, medical implants, oil & gas tubing, and automotive safety components—manufacturers must manage both a Material Test Report (MTR) from their suppliers and a Certificate of Analysis (COA) generated within their own plant. Although these two documents serve related purposes, they originate at different stages of the value chain, which often creates a complex and time-consuming workflow. As production volumes and compliance demands rise, this dual-document requirement has become one of the most underestimated bottlenecks in quality assurance.

Why Both Documents Matter

The MTR provides upstream material assurance. It is issued by the metal mill or supplier and validates the raw material’s chemical composition, mechanical properties, heat number, and conformance to standards such as ASTM or ASME. In simple terms, an MTR answers the question: Was the material manufactured correctly before entering our factory? On the other hand, the COA reflects downstream production validation. It is created by the manufacturer after machining, forming, coating, or heat treatment and includes dimensional checks, surface finish values, additional chemical or mechanical tests, and any customer-specific inspections. A COA answers the complementary question: Did the finished product meet the customer’s exact requirements?

In high-assurance sectors like precision tubing for oil wells, orthopedic components, superalloy blades, and critical automotive parts, customers insist on receiving both documents for each batch. Together, MTRs and COAs provide full lifecycle traceability, from the moment the alloy is melted to the moment the final component is shipped.

Where the Workflow Starts Breaking Down

Handling both MTRs and COAs manually quickly becomes inefficient, especially when manufacturers process dozens or hundreds of batches per day. Quality teams often find themselves spending significant time cross-verifying values from two different documents that rarely follow the same layout. Supplier MTRs come in varied PDF formats, forcing inspectors to search for chemistry, mechanical properties, heat numbers, and material grades across different designs. Meanwhile, COAs require operators to retype test values into ERP systems, quality modules, or customer-specific templates. Even a minor typing error can lead to compliance issues or customer escalations.

Another common issue is the last-minute document scramble before dispatch. Production may finish on schedule, but shipments get delayed because COAs are still being compiled, matched with the correct MTRs, or double-checked for accuracy. For companies operating on tight delivery windows—especially those supplying aerospace or automotive customers—documentation delays quickly become a major operational risk.

How Automation Brings the Process Under Control

Automation platforms designed for industrial documentation offer a structured way to simplify this dual-document workflow. Modern solutions can read MTRs directly from PDFs, regardless of the supplier’s format, and accurately extract critical values such as chemistry, tensile strength, hardness, and heat numbers. This eliminates the need for templates, manual scanning, or repetitive data entry.

At the same time, COA generation can be streamlined by pulling inspection results directly from measurement equipment or internal databases. As soon as final testing is done, the system automatically populates the COA in the correct customer format, eliminating inconsistencies and making the document available far earlier in the dispatch cycle. The real strength of automation is the ability to match MTR and COA data in real time. Heat numbers, material grades, tolerances, and specification limits are cross-validated instantly, and any deviation is flagged for review. This ensures that non-conforming material is caught before it leaves the facility.

Automation also integrates seamlessly with ERP and quality systems. Once documents are validated, they are linked to the correct work order, stored in the system of record, and, if required, automatically shared with the customer. This end-to-end workflow significantly reduces manual handling and creates a reliable audit trail.

What Manufacturers Gain

Manufacturers adopting COA and MTR automation report substantial improvements in efficiency and compliance. Manual processing time drops sharply, freeing quality teams to focus on more value-added tasks. Errors linked to data entry or document mismatches reduce dramatically, improving customer trust and reducing the risk of returns or corrective actions. Shipment delays caused by documentation bottlenecks disappear, enabling a smoother and more predictable dispatch cycle. Perhaps most importantly, companies gain stronger traceability and easier audit readiness—two factors that have become critical in regulated industries.

------------------------

As industries that rely on MTRs and COAs evolve toward tighter specifications and faster delivery expectations, the limitations of manual document handling become more visible. Automating both documents together—not as separate workflows—creates a unified, traceable process that supports quality, compliance, and operational speed. For manufacturers working with high-performance alloys, medical-grade materials, or precision-engineered components, this integrated approach is quickly becoming essential to maintain competitiveness and reliability.