Blogs, News & Articles

Why BABA Projects Now Prefer Automated MTR Workflows

The Buy America/Build America (BABA) clamp-down on documentation for iron, steel, manufactured products, and construction materials is now real on Federal-aid projects. If your Material Test Reports (MTRs) are still paper-bound or scattered PDFs, you’re courting delays, rework, and lost bids. The smartest shops are moving to automated, verifiable “digital MTRs” that plug into digital material passport workflows—giving prime contractors and agencies instant proof of origin, chemistry, and heat traceability. ( Source: Federal Register)

Why this is the moment

Regulatory pressure is peaking: On Jan 14, 2025, FHWA ended the long-standing waiver for manufactured products and set Buy America rules that heighten documentation scrutiny across Federal-aid highway work. Expect prime contractors to push traceability downstream—and walk from suppliers who can’t prove domestic content cleanly.

Agencies are harmonizing paperwork: Federal offices (DOE, EPA, NTIA) have issued BABA templates and FAQs that explicitly call for manufacturer certifications and equivalent documentation—i.e., searchable, auditable records, not email chains. (Source: energy.gov)

States are enforcing at the jobsite: State DOTs (example: Idaho, Oct 2025) now spell out U.S.-origin requirements by material class and expect proof from smelt to final shaping. Field inspectors will ask your foreman for evidence on the spot. Idaho Transportation Department

Margins are tight: ISM shows U.S. manufacturing in contraction—meaning fewer mistakes tolerated and less budget for rework. Automation that cuts non-productive admin is a competitive edge.

The shift: MTRs → Digital Material Passports

Europe’s Digital Product Passport (DPP) is spilling into U.S. metals workflows: OEMs and big primes want interoperable, tamper-evident certificates that follow parts from melt to finish. U.S. steel/metal players have begun partnering to stand up digital material passports—so data can be validated machine-to-machine, not chased by email. Fabricators who can provide passport-ready MTR data will increasingly make shortlists. (Source: circularise.com)

What this means for a fab shop: your “MTR automation” isn’t just OCR. It’s capturing chemistry, mechanicals, heat/lot, cert sign-off, and origin evidence into a structured, queryable record—then linking that record to PO, WPS/PQR, traveler, and final inspection—ready to share upstream in a verifiable format. circularise.com

The business case (beyond compliance)

Bid velocity: Submit clean BABA packages with clicks (cover sheet + linked cert bundle + origin attestations). Primes love fast, audit-ready subs. (Source: BroadbandUSA)

First-time-right fabrication: Auto-flag spec mismatches (e.g., wrong grade/heat for a B31.3 spool) before cutting. That saves shop hours and schedule. (Inference based on required documentation rigor.)

Audit defense in minutes: If a CO asks for chain-of-custody on a member installed last month, you pull a trace in seconds—no binders, no panic.

Trust signal with OEMs: Early adopters of material passports are telegraphing quality and traceability leadership—giving them leverage in frame agreements.

What “good” MTR automation looks like in 2025

Structured data capture: Parse supplier MTRs into fields (heat no., grade, melt source, spec/edition, chemistry, tensile/yield/El, NDE notes) with human-in-the-loop QC on low-confidence reads. (Maps to BABA documentation expectations.)

Origin & process lineage: Record smelt/melt + shaping steps for iron/steel; associate EN 10204 3.1/3.2 cert data where applicable; store manufacturer sign-off and time-stamps.

Digital envelope: Generate a cryptographically signed “certificate bundle” so upstream systems can verify integrity (foundation for material passports). (Industry direction.)

Traceability graph: Link MTRs to POs, receiving lots, work orders, weld maps, and installed locations—so one click traces part → heat → cert. (Auditability expectation under BABA.)

Edition control: Track spec editions (e.g., ASME BPVC updates through 2025) to prevent outdated acceptance criteria in QC.

Field access: Mobile, read-only certs with QR on travelers and nameplates—so inspectors can verify on site. (State DOT enforcement trend.)

A 30-day playbook for U.S. fabricators & metalworkers

Week 1 — Inventory reality check

List all active cert sources (mills, service centers). Sample 50 MTRs; note formats, completeness, and error rates.

Identify your top five BABA-sensitive projects for 2025–26. Map their cert asks back to FHWA rules.

Week 2 — Data model & controls

Define your “Minimum Viable Passport” fields (origin, chemistry, mechanicals, melt/shaping, spec edition, inspector sign-off).

Stand up validation rules: reject mismatched grade/heat, missing melt origin, or stale spec editions. (Aligned to agency doc needs.)

Week 3 — Build the pipeline

Configure OCR/IDP for common MTR templates; route low-confidence fields to QC.

Link certificates to POs, receiving lots, and job travelers; generate a digital certificate bundle (PDF + JSON) per shipment.

Week 4 — Prove and scale

Pilot on one DOT-linked job. Have foremen pull certs by QR in the yard.

Add the BABA Cover Sheet: domestic origin attestation + auto-compiled cert index. Reuse this template in bids.

Real-world scenarios you’ll avoid

The “binder at home” fiasco: State inspector asks for melt origin on a flange. Your superintendent scans a QR and shows melt + shaping steps and the signed MTR—no job stoppage.

Prime’s 24-hour cure notice: A general contractor demands manufactured-product proof under the Jan 2025 rule. You send a single link with the digital bundle and attestation. Issue closed, relationship saved.

Spec edition trap: Your QC catches that a supplier used older acceptance criteria; automation flags it before fabrication, not after install. (Risk tied to 2025 code updates.)

What to ask vendors (so you don’t buy shelf-ware)

Can your system auto-extract chemistry/mechanicals and validate against the ordered spec/edition? (Show me the rule set.)

Do you support origin lineage fields required under BABA (melt/smelt, shaping, final processing) and produce a manufacturer-signed cert bundle?

Can field teams scan a QR to view the exact certs tied to a heat/part—offline if needed?

Do you publish a passport-ready export (API/JSON) to interoperate with primes’ DPP pilots?

How do you handle editions/obsolescence for ASME/AWS/ASTM so QC doesn’t validate against outdated rules?

BABA has turned MTRs from “paperwork” into a profit lever. Shops that automate now will quote faster, clear audits quicker, and become the go-to subs on Federal-aid and public-works jobs. Layering in digital material passports is your hedge against the next wave of data-sharing demands from primes and DOTs. It’s not just compliance—it’s how you protect margin in a slow factory cycle.

How Hybrid OCR with AI Ensures Speed, Accuracy, and Compliance

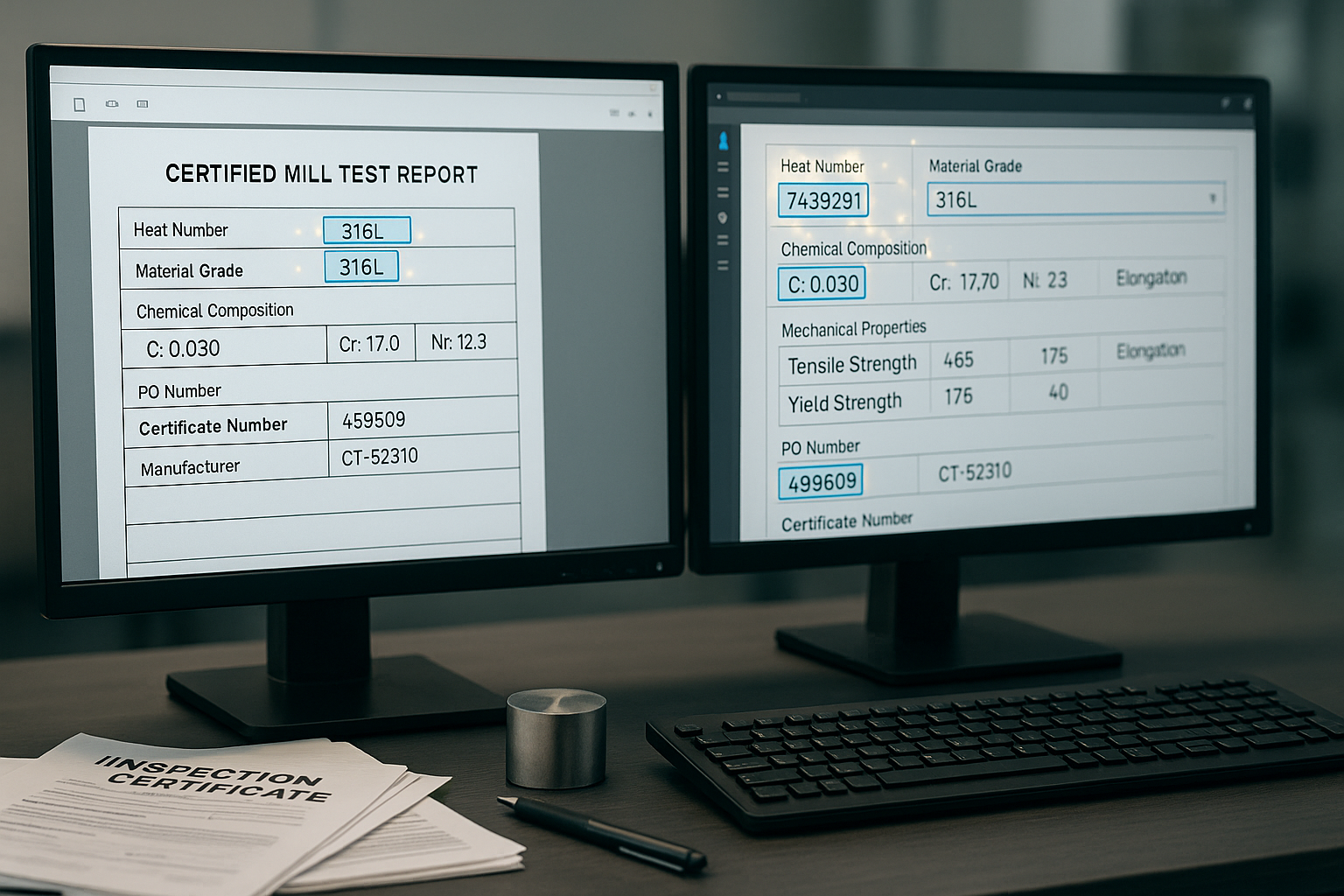

Traceability has become the new quality benchmark for the metals industry. Whether it’s stainless steel tubing for medical use or alloy plates for structural fabrication, every component is expected to come with complete, verifiable documentation — specifically, a Mill Test Report (MTR) that certifies its chemical and mechanical properties.

Yet, despite this growing compliance requirement, many metal service centers and processors still rely on manual typing to extract critical MTR details like heat number, grade, certificate number, and chemical composition from PDF or scanned documents. This traditional process is slow, error-prone, and increasingly unsustainable in an era of digital-first operations.

That’s where Hybrid OCR + AI is changing the game.

The Evolution of MTR Capture

Traditional Optical Character Recognition (OCR) systems were built to read — not to understand. They could convert a scanned certificate into editable text, but struggled with inconsistent layouts, varied supplier templates, and handwritten or low-quality scans. As a result, human operators still had to clean, cross-check, and type data into ERP or quality systems.

Hybrid OCR + AI, however, goes beyond optical recognition. It reads and interprets.

By combining the visual accuracy of OCR with the contextual intelligence of AI models trained on metallurgical documents, this approach can automatically detect and categorize key data fields, including:

Heat number

Material grade and specification

Chemical composition (element-wise values)

Mechanical properties (tensile strength, yield strength, elongation)

Purchase order or line item details

Certificate number and date

Manufacturer or mill information

Each extracted value is validated in real-time against predefined patterns, units, or tolerance thresholds — creating a structured, verified dataset ready for downstream use.

Speed and Accuracy

The biggest transformation lies in processing speed and data accuracy.

Manual typing typically takes several minutes per document — and a mid-sized distributor might process hundreds of MTRs every day. Even with trained staff, fatigue and formatting inconsistencies can lead to misentries that compromise traceability. Hybrid OCR + AI, on the other hand, can process an MTR in under 10 seconds, with accuracy rates exceeding 99% when tuned to domain-specific templates.

This translates to measurable operational gains:

Faster document turnaround – Immediate data availability accelerates order fulfilment.

Improved traceability – Every heat number and property is correctly linked to its corresponding material batch.

Reduced human error – AI validation ensures consistency across thousands of records.

Better audit readiness – Structured data simplifies compliance checks during customer or regulatory audits.

Traceability as a Compliance Imperative

In sectors like aerospace, energy, and automotive, traceability is not optional — it’s mandated. A single mismatch between a material property on an MTR and the one logged in a production record can trigger rework, shipment holds, or costly recalls. Hybrid OCR + AI eliminates these weak links by ensuring that the data extracted from a certificate is exactly what enters the system, leaving an auditable digital trail.

This is particularly valuable during material non-conformance investigations. Instead of manually searching through folders of PDFs, quality engineers can instantly retrieve all MTRs linked to a specific heat number or specification and verify their source accuracy.

The Business Case for Automation

While compliance remains the primary driver, the business case for AI-driven MTR capture is equally strong.

By reducing manual work, organizations can redirect skilled staff from repetitive data entry to higher-value tasks like vendor evaluation, process improvement, and customer engagement.Moreover, when structured MTR data integrates with ERP or MES systems, it enables advanced analytics — helping identify supplier trends, detect recurring material issues, and optimize purchasing based on historical property performance.

What was once a back-office task now becomes a strategic data asset.

As the metals industry continues to digitize, traceability compliance will evolve into a competitive differentiator. Customers increasingly expect end-to-end transparency — from heat number to shipment label — and regulators are tightening quality documentation standards across geographies.

Organizations that continue to depend on manual MTR typing will find it difficult to keep pace with modern quality assurance frameworks. Those adopting hybrid OCR + AI will gain not only efficiency but also data integrity, audit confidence, and faster responsiveness — the cornerstones of digital trust.

Hybrid OCR + AI is more than just a smarter way to read MTRs — it’s a fundamental shift toward data-driven traceability.

By uniting high-speed capture with machine-level accuracy, it removes one of the last manual bottlenecks in metals documentation. The result is clear: fewer errors, faster compliance, and a stronger foundation for intelligent manufacturing.

Star Software’s Custom Approach to MTR Automation: Precision, Intelligence, and Adaptability

Mill Test Reports (MTRs) sit at the heart of this precision-driven ecosystem — serving as the “birth certificate” of every metal product.

Star Software’s AI-powered automation platform, Star Automation, is transforming how manufacturers, distributors, and fabricators manage their MTR workflows. By integrating OCR, AI, and intelligent data validation, the platform not only extracts data but also ensures accuracy, compliance, and traceability — customized to the needs of each client.

The Core of MTR Automation

An MTR contains crucial data points such as Heat Number, Material Grade, Chemical Composition, Mechanical Properties, and Manufacturer Information. Traditionally, these reports have been reviewed manually, often involving hours of cross-verification. Star Automation changes that by introducing an intelligent data extraction process that captures and validates every field with unmatched precision.

Its capabilities go beyond simple OCR reading. Star Automation maps data intelligently into structured formats like Quality Data Sheets (QDS), cross-checks the extracted information with original certificates, and identifies missing or mismatched values in real time. The result — error-free, validated data ready for quality assurance and ERP integration.

Customized MTR Solutions: Real Test Case Scenarios

Star Software’s strength lies in its customized approach to MTR automation. Each client has unique workflows, document formats, and data priorities — and Star adapts seamlessly to them.

Take the Dover Star MTR AI Engine, for example. The system automatically validates document flow from certificate drop to QDS creation. Once an MTR is uploaded to the designated Google Drive folder, the AI engine triggers extraction, runs validation checks on Heat Number, Purchase Order, and Item details, and sends automated pass/fail email notifications. It even detects pre-receiving entries — ensuring every MTR is processed, validated, and communicated without human follow-up.

Another instance is Basic Metals, where Star Automation accurately extracts both chemistry and mechanical data, verifying them against the source certificate. The process ensures full alignment between the manufacturer’s certification and the customer’s quality standards.

For Flack Metals, the focus was on traceability. The test case required validation of Coil and Heat Numbers as mandatory fields. Star’s extraction model automatically recognized these identifiers, populated them accurately, and created Excel-based summaries for Chemistry, Mechanical, and Coil-Heat data — ensuring no material batch was left untracked.

With Three D Metals, the challenge was unit-based mapping. Mechanical parameters like tensile strength were represented differently depending on the measurement system (ksi or MPa). The AI model adapted dynamically, mapping parameter names and values correctly to their respective units, ensuring flawless mechanical data validation.

Triple S Star presented a document complexity challenge — multi-page TIFF files. Star Automation not only processed these but also converted and extracted data across all pages, validating Heat, PO, Mill Name, and Certificate Numbers accurately.

In Lewis Brass, the customer had specific business rules — trimmed Heat Numbers had to be ignored. Star Automation’s logic was fine-tuned to those rules, ensuring the generated certificates matched customer expectations and Sales Order references.

Every one of these cases demonstrates how Star Software doesn’t just automate MTR extraction — it customizes intelligence to align with the customer’s operational and compliance framework.

Scaling Up: The Ferguson Experience

For large-scale operations like Ferguson, automation must balance speed with system-wide accuracy. Star Automation is built to scale, handling multi-vendor, multi-format MTR packets while maintaining complete data integrity.

In Ferguson’s deployment, suppliers upload MTR packets directly to the system. The AI engine distinguishes whether the documents belong to a single vendor or multiple vendors. It then automatically splits, indexes, and assigns them correctly using certificate numbers — a process that would otherwise take hours of manual sorting.

The system also supports QR code integration, linking physical shipments to their digital MTRs. When a QR code printed on a package or pallet is scanned, the corresponding MTR PDF opens instantly — simplifying traceability for logistics and customers alike.

Another layer of intelligence is visible in Star’s search and access management features. Ferguson’s users can search by PO number, Heat Number, Description, or even partial keywords — thanks to an AI-driven OCR filter that accounts for typographical variations and scanned document inconsistencies. The system also ensures role-based access, allowing MTR clerks, supervisors, and customers to interact with data securely within their access level.

During data migration, Star’s automation mapped legacy MTRs from Excel, CSV, and PDF formats into the new database — retaining metadata, linking files, and verifying every Heat and PO Number. This seamless transition ensured Ferguson retained its complete MTR history, now searchable and actionable.

Beyond Extraction: Validation, Traceability, and Insight

Star Software’s MTR automation isn’t limited to data extraction; it’s about building a connected intelligence layer across operations. The system detects missing or inconsistent data, prompts for human verification when confidence scores fall below threshold levels, and maintains version control for every validated MTR.

Moreover, the platform supports direct digital sharing — allowing customers to email MTRs or Packing Slips without printing, reducing paper dependency and turnaround time. Every shared document is traceable, timestamped, and stored securely.

This end-to-end traceability helps companies meet compliance with ASTM, ASME, and ISO standards while strengthening their internal quality management systems.

A Smarter Way to Handle MTRs

What truly differentiates Star Software is its philosophy of intelligent customization. Each implementation reflects a blend of AI precision and business-specific adaptation — whether it’s Dover’s automated validation, Flack’s traceability logic, or Ferguson’s large-scale data migration.

By bridging the gap between document data and operational systems, Star Automation is redefining how manufacturers view MTR management — from a manual, error-prone task to a strategic, automated process that fuels accuracy, compliance, and customer trust.

Star Software’s MTR automation doesn’t just read data — it understands it.

How Predictive Analytics Is Redefining Material Quality Management

Material Test Reports (MTRs) have long served as essential documents that certify a material’s mechanical and chemical properties. Traditionally, MTRs have been viewed as compliance paperwork—used to confirm a product meets ASTM, ASME, or ISO standards. But that perception is rapidly changing.

With AI-driven MTR automation, manufacturers are unlocking the next frontier: predictive analytics. Instead of merely extracting data, companies are learning to use it to forecast quality issues, detect process deviations, and optimize production parameters before problems occur.

Let’s explore how MTR data—when combined with analytics—can transform quality control from reactive to predictive.

From Static Reports to Intelligent Data Assets

Earlier, MTRs were treated as static documents stored in folders or shared as PDFs. Even after digitization, most organizations stopped at data extraction—simply converting MTRs into searchable formats.

However, MTR data contains hidden insights. Each test record holds valuable information about tensile strength, chemical balance, heat treatment, and manufacturing origin. When thousands of such records are aggregated and analyzed, they form a rich database for trend identification and predictive modeling.

For example, a consistent drop in tensile strength for a particular heat lot could indicate a process variation in the mill’s rolling or cooling phase—something that might otherwise go unnoticed until product failure occurs.

Predictive Analytics in Action

Here’s how forward-thinking manufacturers are already leveraging predictive analytics on MTR data:

Trend Identification:

AI tools track gradual changes in mechanical properties across production batches to detect early warning signals of deviation.Supplier Performance Monitoring:

By comparing MTR data across suppliers, manufacturers can identify which vendors consistently meet or exceed material standards.Defect Prediction:

Machine learning algorithms analyze historical data to predict the likelihood of defects in upcoming batches based on previous composition patterns.Process Optimization:

Quality teams use MTR-driven analytics to fine-tune heat treatment or alloy ratios, improving product durability and reducing rework rates.Real-Time Quality Alerts:

Integrated systems trigger alerts when MTR data from a new batch shows outlier properties—allowing instant corrective action before shipment.

Integrating MTR Analytics into the Quality Workflow

To unlock predictive potential, manufacturers must integrate MTR automation with ERP, MES, and quality control systems. The process typically includes:

Automated Data Capture: AI-based Intelligent Document Processing (IDP) extracts and validates MTR data.

Centralized Database: Cleaned, structured data is stored in a central repository for cross-comparison.

Analytics Layer: Machine learning algorithms analyze trends and anomalies across batches, suppliers, and timelines.

Actionable Insights: Dashboards visualize the findings, supporting data-driven decisions in procurement and production.

This approach ensures that quality control evolves from inspection to prevention, making every MTR a strategic asset.

Benefits at a Glance

Faster root-cause analysis and early problem detection

Reduced rework and scrap rates through predictive interventions

Improved supplier evaluation based on performance analytics

Enhanced traceability and compliance readiness

Data-driven production optimization for consistent quality

MTR automation is no longer just about extracting and storing data—it’s about unlocking the intelligence hidden within. By integrating predictive analytics, manufacturers can shift from reactive problem-solving to proactive quality management.

In a competitive metals market, those who treat MTRs as strategic data assets rather than compliance documents will lead the next wave of smart manufacturing.

Top 5 Misconceptions About Mill Test Report Automation

In the metals industry, Mill Test Reports (MTRs) are the backbone of quality assurance. They verify that materials meet required specifications and standards such as ASTM, ASME, or ISO. However, as the industry embraces automation and digital transformation, many professionals remain skeptical about automating MTR management. Misconceptions persist—often rooted in legacy practices and incomplete understanding of what MTR automation truly offers.

Let’s break down the top five misconceptions about MTR automation and uncover the reality behind them.

1. “MTR automation is only for large manufacturers.”

Many believe MTR automation is a luxury reserved for global steel producers or large distributors. In reality, even small and mid-sized metal businesses benefit immensely. Automation eliminates repetitive data entry, reduces errors, and simplifies compliance tracking—allowing teams to focus on customer service and growth.

Cloud-based solutions now make automation affordable, scalable, and easily integrated with existing ERP or inventory systems.Reality: Automation scales with your business size—offering efficiency gains whether you process 50 or 5,000 MTRs per month.

2. “Automated systems can’t interpret complex MTR formats.”

Given the variety of MTR formats from different mills and suppliers, many assume automation tools can’t handle such complexity. Modern AI-driven Intelligent Document Processing (IDP) solutions prove otherwise.

These systems use optical character recognition (OCR) and machine learning to read diverse layouts, extract key data like heat numbers, chemical composition, and mechanical properties, and map them accurately to your database.Reality: Today’s AI-powered MTR automation tools adapt and learn continuously, improving accuracy with every document processed.

3. “Automation will replace my quality control team.”

A common fear is that MTR automation might make certain roles redundant. But the opposite is true. Automation enhances human capability rather than replacing it. Quality and compliance teams spend less time on manual verification and more time on decision-making, root-cause analysis, and continuous improvement.

Reality: Automation augments your team—handling routine work while empowering experts to focus on higher-value tasks.

4. “Automated systems are difficult to implement and integrate.”

This misconception often stops organizations from taking the first step. In truth, MTR automation can be integrated seamlessly with existing systems like ERP, MES, or CRM through APIs. Implementation time depends on the system’s complexity, but modern platforms are built for plug-and-play deployment.

Reality: MTR automation is easier to implement than most expect—often taking just a few weeks with minimal IT support.

5. “MTR automation doesn’t improve compliance.”

Many think automation is purely about speed and data entry. However, it plays a crucial role in traceability and compliance. Automated systems ensure that every heat number, batch, and test result is accurately linked to the right product and customer order. They also generate audit-ready reports, ensuring quick retrieval and zero compliance gaps during inspections.

Reality: MTR automation strengthens compliance by providing real-time traceability, version control, and standardized documentation.

MTR automation is not just about going digital—it’s about building accuracy, consistency, and competitive advantage in an industry where documentation defines trust. Whether you’re a fabricator, distributor, or OEM, embracing automation means fewer manual errors, faster deliveries, and better customer confidence.

In short, it’s time to replace misconceptions with measurable results.