Blogs, News & Articles

How Automated QA Workflows Are Redefining Modern Manufacturing and Compliance

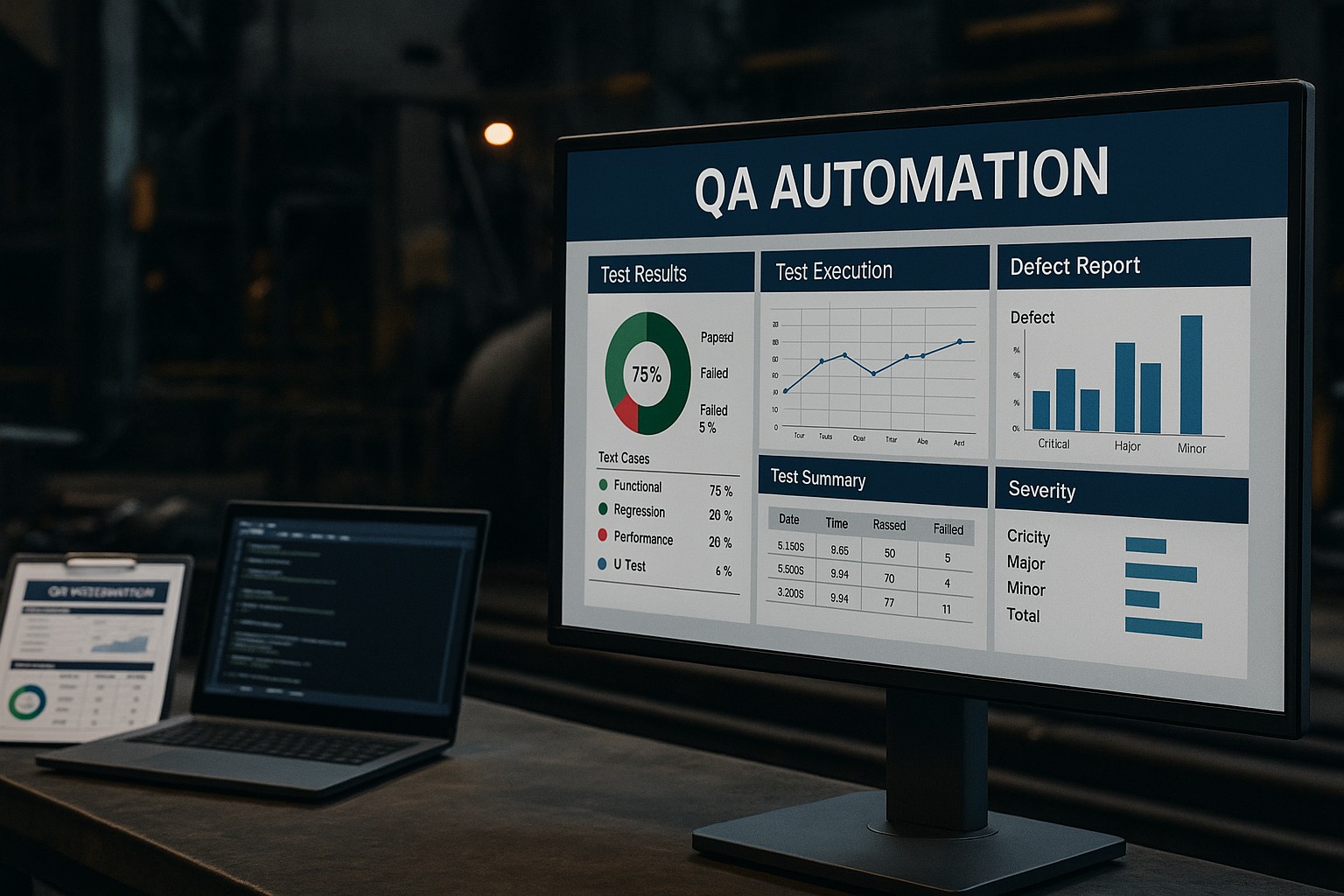

Quality Assurance has always been one of the most critical functions in manufacturing, processing, and regulated industries. From verifying material integrity to ensuring batch-level accuracy in lab results, QA teams sit at the intersection of compliance, production, and customer trust. But in recent years, the volume, complexity, and compliance demand attached to QA documentation have surged — to a point where manual workflows can no longer keep up.

This is where automated QA workflows are transforming how industries operate. With AI-driven systems capable of extracting, validating, and organizing quality data, organizations can now build a digital QA layer that is faster, smarter, and far more scalable than traditional approaches.

Why QA Workflows Need a Digital Overhaul

Most organizations still rely on manual review of documents like Material Test Reports (MTRs), Certificates of Analysis (COAs), batch sheets, inspection reports, and compliance certificates. These documents are essential for verifying quality — but they are also slow and labor-intensive to process.

Some common bottlenecks include:

Handling supplier documents in multiple formats

Manually validating test values against specifications

Copy-pasting data into ERP or LIMS

Tracking deviations and exceptions

Rechecking compliance requirements for audits

These steps create delays in production, increase compliance risk, and consume valuable manpower.

As industries expand and regulations tighten, the question becomes:

How can QA teams maintain accuracy without slowing down output?

The Rise of Automated QA Workflows

Automation is no longer limited to the shop floor; it is now entering the Quality Assurance function with significant impact. Intelligent systems can interpret technical documents, extract properties, validate results, and integrate data with downstream systems — all without human intervention.

This shift is driven by three core advancements:

1. AI-powered document intelligence

Modern systems can read PDFs, scanned images, tables, and lab reports with remarkable accuracy. Whether you’re dealing with steel composition data or pharmaceutical assay results, AI models can extract the exact fields required for decision-making.

2. Automated validation against internal or industry standards

Once extracted, QA data is automatically compared against specifications, tolerance ranges, and compliance rules. This eliminates the repetitive manual work that usually slows down QA cycles.

3. Real-time QA visibility

Digitized QA data is easier to analyze, search, and track. Teams can instantly check deviations, supplier performance trends, and batch-level quality metrics.

Where Automated QA Makes the Biggest Difference

Although automation benefits every sector, some industries see dramatic gains:

Metals & Manufacturing

Documents like MTRs are vital for confirming material grade, tensile properties, chemical composition, and heat traceability. Automated QA reduces the time spent reviewing these certificates and helps teams detect deviations early.

Pharmaceuticals, Chemicals & Laboratories

COAs and lab-generated test results often contain dozens of parameters. Automated QA ensures consistent interpretation of analytical data and helps prepare audit-ready documentation.

Industrial Engineering

Across fabrication shops and OEMs, both incoming material quality and final product validation depend on QA documentation. Automation ensures nothing slips through the cracks.

Food & Packaging

Regulatory requirements around contaminants, additives, and safety standards make COAs critical. Automated workflows help companies maintain consistent quality while speeding up time-to-market.

How Star Software Helps Organizations Modernize QA

Star Software has built a specialized platform that brings intelligent document processing to the QA function. Instead of relying on manual review, the system interprets technical documents, identifies key metrics, flags out-of-range values, and organizes information into structured digital formats.

Whether it’s a batch COA from a pharmaceutical supplier or an MTR from a steel mill, Star’s platform turns unstructured QA documents into actionable digital assets. This helps teams:

Shorten QA review cycles

Reduce manual intervention

Improve accuracy and traceability

Keep audits stress-free

Scale QA processes across plants or regions

For detailed workflows, you can explore Star’s dedicated solutions:

🔗 MTR Automation – https://starsoftware.co/mtr-automation/

🔗 COA Automation – https://starsoftware.co/coa-automation/The Future of QA Is Intelligent, Digital, and Scalable

As supply chains grow more connected and global, the demand for reliable and fast QA processes will intensify. Automated QA workflows will no longer be an optional upgrade — they will become a foundational requirement for operational excellence.

Organizations that embrace this transformation now will:

Process quality documents faster

Strengthen compliance

Reduce operational risk

Free QA teams for higher-value tasks

Build a more resilient quality ecosystem

The shift is underway — and forward-looking companies are already capturing the benefits.

Why Customs Authorities Are Increasing COA Checks on Cross-Border Shipments

International trade has grown in complexity: increasingly, regulatory authorities and customs agencies across the world are treating quality documentation — especially Certificate of Analysis (COA) — as a critical gatekeeper for cross-border shipments. Whether you’re exporting chemicals from India to Europe or importing pharmaceuticals into the U.S., customs scrutiny on COAs has intensified. This trend reflects rising global concern over safety, product quality, counterfeits, and regulatory compliance. This post explores why COAs matter more than ever in international trade — spotlighting regulators such as U.S. Food and Drug Administration (FDA), U.S. Customs and Border Protection (CBP), Central Drugs Standard Control Organization (CDSCO, India), and regulatory regimes in Europe — and how automation can help importers and exporters stay compliant and avoid disruptions.

Why COAs Are Becoming Central to Customs & Regulatory Checks

COAs as Proof of Quality & Safety

A COA provides laboratory-verified details about a product’s composition, purity, contaminants (if any), batch numbers, manufacturing or test date, and more. For industries such as pharmaceuticals, chemicals, food ingredients, or specialty metals and alloys, these details are essential to ensure that the shipment meets safety, quality, and regulatory standards.

When a shipment arrives at customs, authorities may need to verify that the content matches what’s declared — not just in name or quantity, but in quality and compliance. COAs give a traceable, batch-wise certificate of quality that helps customs and regulators determine whether a product is admissible.

Compliance Requirements Are Getting Tighter Globally

In India, the regulatory import regime under CDSCO requires importers of drugs and bulk pharmaceuticals to submit a valid import license or registration certificate. Alongside various documents, consignments often must be accompanied by a COA or equivalent test reports to establish quality and authenticity.

Under India’s customs modernization, certain categories of imports — especially chemicals, pharmaceuticals, or regulated materials — must now include product-specific documents (like COA) in the electronic customs filing system (e-SANCHIT).

For the U.S., imports regulated by FDA (foods, drugs, medical devices, chemicals, other regulated items) must meet the same safety, labeling, and compliance standards as domestic products.

Any entry for FDA-regulated goods must be declared via the import entry process managed by CBP, and goods may be flagged for manual review/refusal if documentation or compliance appears inadequate.

Given rising global incidents of substandard, contaminated or counterfeit goods — especially in food, chemicals, pharma and nutraceuticals — regulators and customs authorities are increasingly vigilant about verifying not just the paperwork, but the actual quality behind consignments.

COAs Build Trust and Traceability — For Buyers, Customs, and Regulators

From the importer/distributor side, having a valid, detailed COA helps accelerate customs clearance, reduces the risk of shipment hold-ups or rejection, secures buyer confidence, and ensures traceability.

For regulators and customs agencies, COAs help enforce compliance, reduce risk of unsafe or non-compliant products entering the domestic market, and support inspection, audit, and recall processes. In sectors where product quality is mission-critical (like pharma or food), COAs are often viewed as the first line of documentation defense.

What Happens When COAs Are Missing, Incomplete or Inaccurate

When a shipment lacks a valid COA — or has a COA that is incomplete, missing required tests, or inconsistent with the product container/batch — several risks arise:

Customs may delay clearance, demand re-testing or additional inspection, or outright refuse the shipment.

For pharmaceuticals, imports may be blocked if registration, license, or required documentation (COA or quality test certificates) are not properly presented under the regulations of importing country (e.g., under CDSCO in India).

For buyers and distributors, absence of COA increases the risk of receiving substandard or unsafe products — which can lead to recalls, regulatory fines, reputational damage, or legal liability.

For exporters, repeated non-compliance can jeopardize future trade, lead to stricter scrutiny, and hamper business relations.

Given the stakes, many buyers and quality-conscious importers now refuse to accept shipments without a valid, batch-wise COA, especially for regulated or high-risk goods.

Why Customs & Regulators Are Increasing COA Checks

Several trends are intensifying the demand for COAs in cross-border trade:

Globalization & complex supply chains. As imports come from many countries, ensuring consistent product quality becomes harder. Regulators rely on COAs to standardize compliance across diverse origins.

Regulatory updates in major markets. Custom modernization and digital filing systems (e.g., India’s e-SANCHIT) now mandate product-level documentation, including COAs, especially for regulated goods.

Rising health, safety and quality incidents. With growing recalls and enforcement actions globally, regulators are more cautious — documentation like COAs helps them mitigate risk at the border.

Need for traceability & audit readiness. COAs link specific batches to test results, enabling traceability, recall-readiness, and easier audits when compliance or safety issues surface.

Pressure from buyers and downstream supply-chain partners. Increasingly, distributors, retailers or downstream manufacturers demand traceable quality documentation (COA or lab reports) — making COA a commercial necessity, not just regulatory.

How Automation Makes COA Compliance Easier for Cross-Border Trade

Given the increasing complexity — multiple batches, multiple suppliers, diverse documentation formats, and tight timelines — manual COA handling becomes risky, error-prone and slow. Here’s where automation helps significantly:

• Centralized digital COA repositories

Instead of PDF folders or paper-based storage, automation platforms let you maintain a structured database of COAs — searchable by batch, supplier, HS code, date, test parameters, etc. This ensures quick retrieval when customs or clients ask for documentation.

• Template and compliance-check workflows

Automated systems can enforce COA submission rules based on product type, destination country, regulatory requirements. For instance, when exporting bulk drugs to India or pharmaceuticals to the U.S., the system can automatically remind or block if COA is missing or incomplete.

• Standardization & validation of COA format

Suppliers often send COAs in varying formats. Automation tools can parse COAs, standardize fields (batch number, analytes, test dates, lab name, signature), and validate completeness — reducing risk of rejection at customs due to missing or non-standard information.

• Integration with shipment & customs-filing systems

By linking COA data with shipment metadata (HS codes, packaging, lot numbers) and customs-filing platforms, automation can pre-populate customs documentation (invoice, packing list, COA reference) — speeding up clearance.

• Audit trail and traceability for regulators and buyers

When COAs are digitally recorded and tied to batch and shipment data, you get full traceability: which batch, when tested, by whom — crucial if customs ask for verification, if there’s a recall, or for compliance audits.

What Importers & Exporters Should Do to Stay Ahead

Treat COA as a core document, not optional: For regulated goods — pharma, chemicals, food additives, specialty metals etc. — assume that customs or buyers may ask for COA, especially in stricter markets.

Use digital COA management — link COAs to batches and shipments: Avoid manual filing; use a database or document-management system so COAs are easily retrievable and associated with the right lot.

Validate COA completeness before shipment: Ensure COAs have batch number, test results, test methodology, lab name and signature, and are consistent with the physical shipment (HS code, quantity, lot).

Check destination-country-specific requirements: For certain markets (like India, EU, U.S.), additional import licenses, product registration, and labelling may be needed — COA alone may not suffice.

Build compliance workflows: Automate COA submission, validation, and linking with customs filing or ERP/shipment systems to avoid human error and delays.

COA — From Quality Paperwork to International Trade Imperative

Nowadays, a COA is far more than a “nice-to-have” — it’s becoming essential documentation for compliance, customs clearance and commercial trust. As regulators and customs authorities tighten checks (in countries such as India, the U.S., and across Europe), companies trading in pharmaceuticals, chemicals, metals and other regulated materials must treat COA compliance as mission-critical.

For importers and exporters, adopting automation for COA management isn’t just about efficiency — it’s a strategic move to ensure smooth cross-border trade, avoid regulatory risk, and maintain credibility with buyers and regulators alike. In the current trade environment, smart COA management and automation might just be the difference between a smooth customs clearance and a shipment stuck in limbo.

----------------------------------------------------------------------

Related Posts:

Interested to know Why Star Software Stands Apart in MTR Automation?

Securing Material Data in Digital Manufacturing with RBAC

As manufacturers accelerate their shift toward digital operations, one area has quietly become a high-value target for cyber threats: material documentation. Mill Test Reports (MTRs), Certificates of Analysis (COAs), heat numbers, product grades, and compliance records contain sensitive, business-critical information that can directly impact quality, traceability, and customer trust.

In the age of digital manufacturing, where automated workflows, shared portals, and cloud-based document repositories are becoming the norm, securing this sensitive data is not optional—it is foundational.

Why Material Data Is More Sensitive Than Most Companies Realize

Material certificates are not just documents; they are compliance assets. They carry:

Chemical and mechanical properties

Heat numbers and batch details

Vendor test results

Regulatory declarations (REACH, RoHS, PED, ISO, AS9100)

Customer product specifications

A leaked or manipulated MTR can trigger production faults, failed audits, warranty risks, and even legal liabilities. In industries such as aerospace, automotive, oil & gas, structural steel, or life sciences, this data directly influences safety and certification outcomes.

Yet, as companies digitize, many still store material documents in shared drives, email folders, or loosely managed cloud storage—leaving them exposed to unauthorized edits and uncontrolled access.

Cybersecurity Gaps Emerging in Modern Documentation Workflows

Digital documentation introduces new security risks:

1. Unrestricted Access to Sensitive Material Data

If every user can view, download, or edit MTRs, the risk of accidental changes or intentional misuse spikes dramatically.

2. Lack of Visibility Into Who Changed What

Without audit logs or controlled permissions, organizations cannot trace edits, deletions, or document movements.

3. Customer Portals Without Proper Restrictions

Allowing customers to access MTRs without limiting visibility may unintentionally expose internal or vendor-specific information.

4. Scattered Documentation Across Email Threads

Email remains the single biggest source of data leakage—yet many certificates still flow through it.

Digital manufacturing amplifies these risks, making secure access architecture critical.

Role-Based Access Control (RBAC): The Modern Security Backbone

This is where Role-Based Access Control (RBAC) emerges as a core cybersecurity framework for digital documentation.

RBAC ensures that each user gets only the access they need—nothing more, nothing less.

With RBAC, organizations can set granular roles such as:

MTR Clerk – Can upload and tag documents

Quality Inspector – Can view and verify but not edit

Supervisors – Can approve, correct, or override

Customers – View-only access to specific order-linked documents

Vendors – Controlled document submission permissions

This prevents unauthorized editing, protects audit integrity, and ensures sensitive data remains secure within defined access boundaries.

How Star Software Strengthens Material Data Security With RBAC

Star Software’s MTR automation platform is built with deep RBAC architecture, designed specifically for metals, manufacturing, and industrial supply chains. Key security capabilities include:

✅ Granular Role Permissions

Admins can define add/edit/view/download rules for each role—ensuring sensitive material properties and heat data stay protected.

✅ Audit Trails for Compliance

Every user action—uploading, editing, approving, or deleting a document—is logged, supporting ISO, IATF, AS9100, and customer audits.

✅ Secure Customer & Vendor Portals

Customers get read-only access to relevant certificates, without exposing internal data. Vendors can upload documentation but cannot view plant records.

✅ Controlled Multi-Plant Access

Users can be restricted to specific plants, teams, or customer accounts, reducing cross-location risk.

✅ Centralized Governance

All permissions, logs, and document histories are managed centrally, eliminating scattered storage and shadow documentation practices.

In short: Star Software brings enterprise-grade cybersecurity to a domain that has long been overlooked—materials documentation.

Why Cybersecurity + RBAC Will Define the Future of Digital Manufacturing

As factories adopt Industry 4.0 technologies—automated inspection, IoT monitoring, digital twins, and AI-driven predictive systems—the value and vulnerability of documentation will continue to rise.

Organizations that secure their material data today will gain:

Stronger audit readiness

Fewer errors caused by unauthorized edits

Higher confidence in MTR accuracy

A safer customer-facing documentation workflow

Lower compliance risk and legal exposure

A modern, scalable, digital-first documentation strategy

Digital manufacturing is not just about automation. It’s about responsible digital stewardship.

Protecting material documentation isn’t a technical upgrade—it’s a strategic imperative.

Why Advanced Search & Fuzzy Filters Are Critical for High-Compliance Industries

In metals, manufacturing, and industrial supply chains, documentation issues continue to be one of the biggest reasons behind production delays. Missing mill test reports (MTRs), incomplete vendor certificates, or wrongly indexed documents often force teams to halt operations, chase vendors, or re-run quality checks. While most companies have digitized their workflows, document verification still depends heavily on manual search and review—reducing first-pass yield (FPY) and increasing approval turnaround time.

A growing number of manufacturers are now turning to AI-powered keyword filters to solve this long-standing bottleneck. Intelligent filtering is rapidly becoming the backbone of modern documentation workflows, enabling faster vendor verification, quicker QC approvals, and significantly fewer rejections due to incomplete information. In this context, Star Software’s MTR automation platform stands out for its advanced capabilities in this area.

Why First-Pass Yield Still Suffers in Document-Heavy Industries

Vendors submit documents in multiple formats—PDFs, scans, mobile images—often containing inconsistent naming conventions. Quality teams then need to manually search for PO numbers, heat numbers, ALT codes, descriptions, or grade details before they can approve a shipment. Any OCR error, mistyped value, or missing keyword can lead to:

Repeated back-and-forth with vendors

Delays in material release

Higher non-compliance risk

More rejected lots due to “missing documentation”

These delays compound during monthly peaks, multi-plant operations, and rushed customer orders.

AI Keyword Filters: Solving the Core Problem

Star Software’s platform leverages AI-powered keyword and fuzzy filters to automatically surface the right documents—even when the input is incomplete or contains errors. Key features include:

Search by PO#, Heat#, ALT code, description or partial keywords

OCR-tolerant fuzzy search for scanned documents

Rapid retrieval even when filenames or indexes are wrong

Structured validation to ensure no critical document is overlooked

Thanks to this intelligent layer, quality and vendor teams can shift from reactive searching to proactive assurance.

Faster Vendor Verification

Vendor compliance teams often struggle with mismatched or mis-labelled documents. With Star Software’s solution:

Incoming vendor documents are automatically scanned for required fields

The system matches certificates to the correct purchase order

ALT codes and grade info are recognized, even with partial data

Missing or inconsistent fields are flagged immediately

This results in faster vendor onboarding, fewer delays in documentation hand-off, and improved material flow into production.

Quicker QC Approvals

Quality inspectors frequently operate under tight timelines. When Star Software’s AI-powered filter locates all related MTRs or certificates instantly—despite OCR issues or partial search terms—QC approvals accelerate significantly. With all supporting records identified, inspectors spend less time digging through folders and more time on value-added review, increasing throughput without additional headcount.

Fewer Rejections Due to Missing Documents

One of the most overlooked benefits of intelligent filtering is error prevention. Misfiled or mis-labelled documents often sneak through until a shipment is rejected or an audit fails. Star Software’s solution helps mitigate this by:

Detecting mismatches between metadata and actual document content

Surfacing correct records even when filenames are wrong

Ensuring no document is ignored because of OCR mis-reads

Reducing dependency on manual memory or tribal knowledge

The result: a consistent, reliable documentation pipeline that supports higher first-pass yield.

A Strategic Advantage for Operations & Customer Commitments

In industries where compliance drives customer trust, documentation accuracy is non-negotiable. By deploying Star Software’s advanced search and fuzzy-filter capability manufacturers can achieve measurable improvements across:

Traceability from mill to finish

Audit readiness and regulatory compliance

Production planning & scheduling reliability

Customer service responsiveness

When documentation is instantly verifiable, downstream functions such as production, dispatch and sales operate more smoothly.

AI-powered keyword and fuzzy filters are redefining how manufacturers tackle documentation-heavy workflows. Through solutions like Star Software’s MTR automation platform, organizations can eliminate manual search bottlenecks, accelerate vendor verification, reduce QC rejection rates, and significantly improve first-pass yield.

For high-volume, compliance-driven industries this isn’t merely an efficiency upgrade—it’s a competitive edge.

Fake COAs Are Surging: How AI Automation Is Protecting Pharma, Chemicals & Metals

Counterfeit products and falsified documentation have become a growing—and dangerous—problem for global supply chains. Among the most damaging of these deceptions are fake Certificates of Analysis (COAs): documents that assert the composition, purity, and test results for raw materials, intermediates and finished goods. When COAs are forged, tampered with, or recycled, the consequences range from delayed shipments and regulatory action to product recalls, patient harm and reputational collapse. This piece explains recent examples of COA-related fraud, why COAs are attractive targets, and how AI-driven verification and automation are becoming essential defenses for supply-chain resilience.

Why COAs are such an attractive target for fraud

COAs sit at the intersection of trust and verification. Buyers depend on them to accept incoming batches without re-testing; regulators use them to approve imports and audits; manufacturers rely on them to maintain production schedules. That broad trust makes COAs a single point of failure: a falsified COA can let substandard or contaminated material pass into production, or be used to conceal diverted or counterfeit goods. Fraud often takes forms such as altered test values, forged laboratory headers and signatures, reused COAs for different batches, or entirely fabricated documents issued by sham laboratories. The stakes are particularly high in pharmaceuticals, chemicals and metals where small changes in composition or contamination can be catastrophic.

Recent examples and the scale of the problem

High-profile investigations into contaminated medicines and unsafe ingredients have repeatedly unearthed falsified paperwork—COAs included—used to hide poor manufacturing or to enable rogue suppliers to ship substandard products. A joint WHO–UNODC review of contaminated medicines documents multiple incidents where falsified quality certificates and test reports were part of the deception chain that put patients at risk. These are not isolated; customs and trade-monitoring agencies continue to report large volumes of counterfeit goods and related documentation fraud across regions.

While individual, centralized datasets on “number of fake COAs” are scarce (fraud is often discovered only after damage occurs), the anecdotal and investigative evidence—plus rising enforcement actions against counterfeit supply chains—make clear that COA fraud is not a niche problem. Industries from food and nutraceuticals to specialty chemicals and metals increasingly cite document tampering as a systemic vulnerability.

How fraud happens (common patterns)

Document forgery — creating an entirely fake COA with forged lab letterheads and signatures.

Tampering — editing legitimate COAs (e.g., altering numeric values, changing batch numbers).

Re-use / recycling — using the same COA for multiple batches or different products.

Sham lab reports — issuing COAs from laboratories that do not exist or that are not accredited.

Social engineering / collusion — insiders in labs, shippers, or procurement colluding to misrepresent results.

These methods are increasingly sophisticated: fraudsters can convincingly reproduce documents, spoof email domains, and even create websites that impersonate accredited testing labs. That makes manual, eyeball-based verification slow and error-prone.

Why manual checks fail—and where automation fits

Quality teams traditionally rely on spot-checks, sample re-testing, and manual review of COAs. But manual review struggles for three reasons:

Volume & diversity: Modern supply chains receive hundreds or thousands of COAs in multiple formats, languages and file types.

Human error: Typos, tiny unit mismatches, or subtle layout changes can be missed by reviewers.

Speed vs. Safety trade-off: Re-testing every delivery is costly and slows operations; accepting COAs without robust checks creates risk.

Automation removes the bottleneck by turning verification into a scalable, auditable process that focuses human attention where it's most needed.

How AI-driven verification stops tampering and forgery — the toolbox

Modern solutions combine OCR, natural language processing, rules engines, machine learning anomaly detection, and immutable logging. Key capabilities:

Robust data extraction (AI-OCR): Machine learning OCR reads COAs across formats (PDF scans, images, tables) and extracts structured fields—batch number, expiry, test results, units, lab name—far faster and more reliably than manual entry. This is the foundation for any downstream checks.

Schema & semantic validation: Extracted values are validated against expected schemas (e.g., permitted units, analyte names) and supplier-specific templates to catch swapped fields or unit mismatches. Rules engines codify business logic: acceptable tolerances, required signatures, and mandatory tests for a given material.

Anomaly detection & trend analysis: ML models compare incoming COAs to historical supplier patterns. Sudden deviations in typical assay values, missing tests, or improbable consistency between unrelated analytes trigger alerts for deep-dive review. This helps detect sophisticated tampering that changes numbers but not format.

Provenance & immutability (QR, digital signatures, blockchain): Embedding QR codes, cryptographic signatures, or blockchain anchors into COAs ensures recipients can cryptographically verify that a COA originated from the claimed lab and has not been altered. These techniques are increasingly used by legitimate labs to provide end-to-end proof of authenticity.

Source verification & supplier portals: Automated systems cross-check lab accreditation databases, supplier portals, and known-good templates. Integrations with Laboratory Information Management Systems (LIMS) allow cross-validation against original lab records.

Review-by-exception workflows: Instead of examining every COA, automation handles routine validation and routes only flagged documents to human reviewers—reducing turnaround times and concentrating expertise on high-risk cases.

Business impact: measurable benefits

Companies that adopt AI-powered COA verification report faster inbound acceptance, fewer production delays, and reduced re-testing costs. Beyond operational efficiency, automation reduces regulatory risk (by providing auditable trails), improves supplier governance through data-driven scoring, and strengthens customer trust—critical in regulated industries such as pharma and food. Vendors and case studies from document-AI providers demonstrate significant time savings and reduction in manual errors.

Implementation essentials—what procurement and QA teams should demand

Accuracy on messy inputs: The AI should be trained to handle scanned, handwritten and multi-layout COAs.

Explainability: When the system flags a COA, it must show exactly why—what field, what rule, what anomaly—so QA can act fast.

Integration with LIMS / ERP: Verification is most valuable when tied to lab master data, inventory receipts and supplier records.

Immutable verification layer: Prefer solutions that support cryptographic signatures or QR/blockchain anchoring for provenance.

Audit trails & compliance reporting: Automated logs should support audits and regulatory submissions.

-------------------------------------------------------------------

COA fraud is not merely a paperwork problem; it’s a supply-chain vulnerability with safety, financial and legal consequences. The solution isn’t just more manual scrutiny—it’s smarter automation. AI-driven COA verification transforms COAs from static PDFs into live, auditable evidence: speeding acceptance, preventing fraud, and enabling procurement and quality teams to manage risk at scale. For regulated industries where trust is literally life-critical, this shift from reactive inspection to preventive verification is no longer optional—it’s essential