Blogs, News & Articles

MTR Automation for ASTM, EN, and ISO Compliance: A U.S. Manufacturer’s Guide

Global manufacturers face growing pressure to prove material compliance, and Material Test Reports (MTRs) are central to that mission—ensuring product integrity, traceability, and audit readiness.

For U.S.-based manufacturers and suppliers in industries like metals, aerospace, automotive, and construction, adhering to ASTM, EN, and ISO standards is not just good practice—it’s a market requirement.

Yet, many companies still rely on manual or semi-digital MTR handling processes, which are prone to errors, inconsistencies, and non-compliance risks. As compliance demands grow more stringent, MTR automation is emerging as a strategic advantage.

This article explores how automating your MTR workflows strengthens compliance, streamlines audits, and opens doors to international markets.

The Compliance Challenge: More Standards, More Scrutiny

Manufacturers today must align with:

ASTM standards for material and product properties in the U.S.

EN standards for conformity in European markets.

ISO standards for global quality management and traceability.

Each requires strict documentation of chemical composition, mechanical properties, heat numbers, and batch traceability. Manual processes—scanning, emailing, re-keying—make it hard to maintain consistent, audit-ready reports.

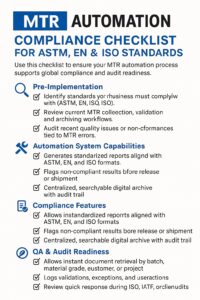

How MTR Automation Ensures Compliance

One of the first advantages of MTR automation is standardized formatting. Automated systems produce MTRs that consistently follow the required layout and structure for ASTM, EN, and ISO standards. This reduces the likelihood of rejections by customers or regulatory bodies due to inconsistent or incorrect documentation.

Next, MTR automation eliminates human error by accurately capturing data using Optical Character Recognition (OCR) and Natural Language Processing (NLP). These technologies extract test values such as tensile strength, hardness, or chemical analysis from varied document formats—whether PDF, scan, or image—with precision. This accuracy is essential for maintaining data integrity during audits or quality investigations.

Automation also strengthens traceability. Every automated MTR can be linked to corresponding heat numbers, batch codes, and shipment records in your ERP or quality management system. This traceability not only fulfills ISO 9001 and ASTM traceability requirements but also enables faster material recall or investigation in the event of a non-conformance.

Moreover, automated systems allow you to define validation rules based on specific compliance thresholds. For example, if the carbon content in a sample exceeds ASTM A36 limits, the system immediately flags the issue and alerts the quality team. This kind of real-time exception management is difficult to achieve with manual checks and helps prevent non-compliant materials from moving forward in the production or shipping process.

MTR automation also builds audit readiness. By storing each report in a searchable digital archive, organized by customer, batch, material grade, or project, your team can retrieve documents instantly during internal or external audits. This dramatically reduces the effort and time required to prepare for ISO 9001, IATF 16949, or EN 10204 audits.

Real-World Impact

Consider a Texas-based steel service center aiming to expand into the European market. By implementing MTR automation, they were able to validate reports against both ASTM and EN specifications and centralize their documentation. The results were compelling: a 43% reduction in non-conformances, a 70% drop in audit preparation time, and a 30% increase in export volume to EU clients.

Compliance is no longer a back-office function—it is a strategic capability. Automating your MTR process is one of the most impactful steps you can take to meet global quality standards, reduce operational risk, and build trust with international partners.

In a regulatory environment where every detail matters, MTR automation gives you the confidence, control, and consistency you need to stay ahead.

Integrating CoA Automation into ERP and LIMS: What You Need to Know

For organizations in pharmaceuticals, chemicals, and food manufacturing, the Certificate of Analysis (CoA) is a vital document that certifies a product’s compliance with predefined quality specifications. However, when CoA processing remains manual or semi-digital, it becomes a bottleneck—delaying product release, increasing error risk, and complicating compliance.

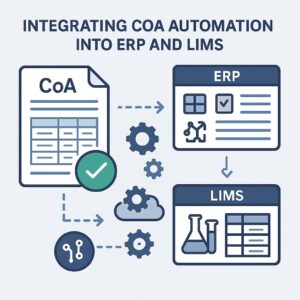

The answer lies in CoA automation, but to unlock its full potential, it must be seamlessly integrated into your ERP (Enterprise Resource Planning) and LIMS (Laboratory Information Management System) platforms. Here’s a step-by-step guide on how to do just that.

Why Integrate CoA Automation with ERP and LIMS?

Before jumping into the ‘how’, it’s crucial to understand the ‘why’:

Centralized Data Flow: Ensures CoA data is synchronized across procurement, quality, and production systems.

Faster Release Cycles: Real-time CoA validation speeds up batch release decisions.

Audit Readiness: Traceable, timestamped entries make regulatory audits smoother.

Supplier Collaboration: Auto-ingestion of third-party CoAs into internal systems saves time and reduces risk.

Step-by-Step Integration Checklist

✅ 1. Assess Your Current Workflows

Map out how CoAs are currently received, verified, and entered into your ERP/LIMS.

Identify bottlenecks—manual data entry, missing validations, or inconsistent formats.

✅ 2. Define Integration Goals

What are you aiming to automate—CoA intake, validation, comparison, storage, or all of the above?

Decide which systems should “talk”—ERP, LIMS, document management systems, or supplier portals.

✅ 3. Choose the Right CoA Automation Tool

Look for a platform that includes:

Intelligent Document Processing (IDP) with OCR & NLP

Custom validation rules (e.g., specification ranges, batch ID matching)

APIs or connectors for ERP (SAP, Oracle, NetSuite) and LIMS (LabWare, STARLIMS, etc.)

Audit trails and version control

✅ 4. Design the Integration Architecture

Decide whether it will be a direct API-based integration or via middleware like Mulesoft, Boomi, or Workato.

Build mapping logic for how CoA fields will correspond to ERP/LIMS entries (e.g., batch number → material master, test results → QC module).

✅ 5. Establish Validation Rules and Alerts

Set up business rules for automatic CoA validation (e.g., moisture content < 2%).

Configure exception alerts to notify quality teams for out-of-spec results.

✅ 6. Pilot with Key Vendors

Start with a limited group of suppliers who consistently send digital CoAs.

Run a pilot, compare output with manual processes, and refine as needed.

✅ 7. Train Users and Monitor Adoption

Provide training for QC analysts, procurement staff, and IT teams.

Monitor the adoption rate, error reduction, and efficiency gains post-integration.

✅ 8. Ensure Compliance and Security

All integrations must be 21 CFR Part 11 and GDPR-compliant where applicable.

Use secure data transmission protocols and implement role-based access controls.

Common Pitfalls to Avoid

🔴 Ignoring format diversity: Vendors send CoAs in varied formats (PDFs, scans, Word files)—ensure your tool handles all.

🔴 Not involving end-users early: QC teams must be part of design and testing phases.

🔴 Overlooking change management: Automation is not just tech—it’s a culture shift.

CoA automation is a game-changer—but it becomes truly powerful when tightly integrated with Enterprise Resource Planning (ERP) and Laboratory Information Management Systems (LIMS). With the right architecture, validation logic, and training, you can significantly reduce manual errors, accelerate batch release, and gain real-time insights across your supply chain and quality operations.

If your organization is preparing to take this leap, use the checklist above as your roadmap—and take it one integration point at a time.

Top Accounts Payable Metrics to Track in 2025

As finance teams shift from transactional to strategic roles, the way we measure accounts payable performance is also evolving rapidly.

Accounts Payable (AP) is no longer a back-office function—it’s a strategic lever for improving cash flow, supplier relationships, and financial agility. In 2025, as automation, AI, and real-time analytics reshape finance operations, the metrics that matter most in AP are evolving.

CFOs and AP leaders are moving beyond basic cost-per-invoice calculations to focus on deeper insights that reflect process maturity and digital transformation. This blog explores the key AP metrics that matter in 2025, why they’re important, and how leading companies are using them to drive results.

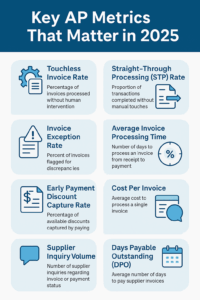

1. Touchless Invoice Rate

What It Measures:

The percentage of invoices processed from receipt to payment without any human intervention.Why It Matters in 2025:

Touchless processing is the hallmark of a mature AP automation setup. High-performing AP teams are aiming for 80%+ touchless rates to reduce errors, speed up cycle times, and cut costs.Real-World Insight:

A U.S.-based manufacturing firm using AI-powered invoice automation reported a 72% touchless invoice rate, leading to 40% faster approvals and a 25% drop in late payments.2. Straight-Through Processing (STP) Rate

What It Measures:

The proportion of transactions that go through the entire process—receipt, matching, approval, and payment—without manual touches.Why It Matters in 2025:

STP reduces bottlenecks and frees up your AP team to handle exceptions rather than routine work.Industry Benchmark:

Top-quartile companies report STP rates above 75%, compared to less than 30% in low-performing organizations.3. Invoice Exception Rate

What It Measures:

The percentage of invoices flagged for discrepancies like missing POs, incorrect amounts, or duplicate entries.Why It Matters in 2025:

High exception rates are red flags for upstream issues in procurement or supplier onboarding. Automation in 2025 includes intelligent matching and validation layers to reduce exceptions.Pro Tip:

Target an exception rate below 10% for healthy AP workflows.4. Average Invoice Processing Time (Invoice Cycle Time)

What It Measures:

The number of days it takes to process an invoice from receipt to payment.Why It Matters in 2025:

With dynamic discounting and real-time analytics, faster invoice turnaround means more opportunities for early-payment discounts and fewer late fees.Benchmark:

Top-performing companies are processing invoices in 5 days or less with full automation.5. Early Payment Discount Capture Rate

What It Measures:

The percentage of available early payment discounts that are actually captured.Why It Matters in 2025:

As interest rates stay volatile, capturing early payment discounts is an easy win for cost savings—if your process is fast and predictable enough.Best Practice:

Integrate dynamic discounting logic into your AP platform to automatically optimize payment timing.6. Cost Per Invoice

What It Measures:

The total cost (labor, systems, overhead) to process a single invoice.Why It Still Matters:

While more AP teams are focused on strategic metrics in 2025, cost-per-invoice remains a fundamental benchmark for operational efficiency.Industry Benchmark:

Manual processes cost $10–15 per invoice; best-in-class automation can bring this down to $1–3.7. Supplier Inquiry Volume

What It Measures:

The number of supplier emails or calls asking about invoice or payment status.Why It Matters in 2025:

A spike in inquiries often signals poor communication or lack of transparency. Self-service portals and automated notifications can reduce friction.What to Watch:

Aim for a drop of 40–60% in supplier inquiries post-automation.8. Days Payable Outstanding (DPO)

What It Measures:

The average number of days a company takes to pay its suppliers.Why It Matters in 2025:

DPO is a key working capital metric, and automation gives AP leaders more control over payment timing to align with cash flow strategies.Balance Is Key:

Too high a DPO could hurt supplier relationships; too low, and you may lose liquidity advantages.In 2025, modern AP teams are not just tracking data—they’re using it to drive action. With intelligent automation platforms, real-time dashboards, and embedded analytics, finance leaders can monitor what matters and make smarter decisions faster.

Focusing on the right AP metrics helps you:

Uncover process bottlenecks

Improve supplier relationships

Strengthen cash flow

Justify the ROI of AP automation investments

If your organization still measures AP success solely by cost savings, it’s time to broaden the lens. The future of accounts payable is strategic—and the metrics must reflect that.

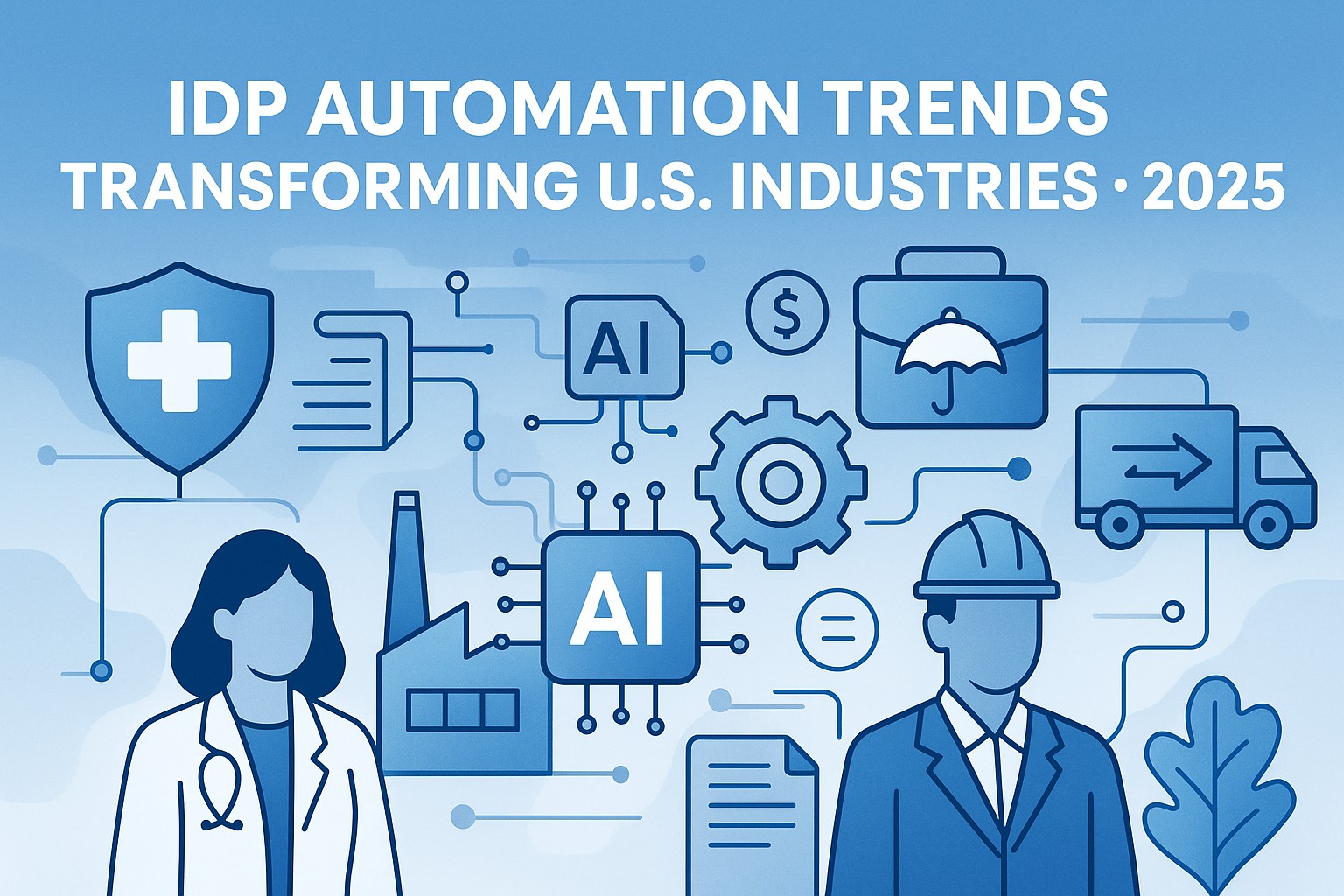

Top 5 IDP Automation Trends Reshaping U.S. Industries in 2025

As U.S. enterprises embrace digital transformation, Intelligent Document Processing (IDP) is emerging as a game-changer across sectors. IDP uses AI, OCR, NLP, and machine learning to extract, classify, and validate data from unstructured and semi-structured documents—reducing manual work and human error, while accelerating workflows.

In 2025, IDP is not just about scanning documents—it's enabling smarter business operations. Here are the top 5 trends shaping IDP automation across U.S. industries, along with real-world examples:

1. Healthcare Turns to IDP for Claims and Patient Onboarding

Trend: IDP is streamlining the extraction of data from EHRs, insurance claims, lab reports, and intake forms—critical in a sector drowning in paperwork.

Example:

Mayo Clinic integrated an IDP platform with its patient onboarding system to automate intake forms. The result? A 40% reduction in data entry time and improved first-time accuracy for insurance claims. This not only sped up reimbursements but also allowed staff to spend more time on patient care.2. Manufacturing Adopts IDP to Streamline Supply Chain Docs

Trend: Manufacturers are leveraging IDP to digitize and verify purchase orders, bills of lading, invoices, and mill test reports (MTRs).

Example:

Caterpillar Inc. used IDP to automate the extraction and validation of specs from MTRs for steel components. This ensured faster compliance with quality control standards and helped identify inconsistencies before parts entered assembly, reducing rework costs by nearly 25%.3. Banks Use IDP to Improve KYC and Loan Processing

Trend: Financial institutions are turning to IDP to accelerate KYC, credit scoring, and loan documentation, where verification of large volumes of data is essential.

Example:

Wells Fargo adopted IDP to streamline commercial loan onboarding. By automating the extraction of data from tax forms, income statements, and business registrations, they cut loan processing time from 12 days to under 5, boosting customer satisfaction and reducing abandonment rates.4. Insurance Accelerates Underwriting and Claims with IDP

Trend: Automation of claims forms, policy documents, and risk reports through IDP is transforming insurance underwriting and fraud detection.

Example:

State Farm deployed an IDP solution to process auto accident claims that include driver statements, images, and police reports. The system automatically triages claims, extracts relevant details, and flags inconsistencies. This shortened claim resolution times by 35% and improved fraud detection by 20%.5. Logistics and Transportation Enhance Document Compliance

Trend: IDP is used to process customs forms, freight invoices, and delivery receipts, enabling faster movement of goods and lower compliance risk.

Example:

UPS implemented an IDP-powered customs documentation system for international freight. It processes thousands of waybills and compliance documents daily, ensuring real-time flagging of missing info and reducing delays at ports of entry. This increased delivery predictability, especially for cross-border e-commerce shipments.IDP is no longer a back-office tool—it’s becoming a front-line enabler of agility, compliance, and customer experience. As we move deeper into 2025, the companies that harness IDP automation to rethink document-heavy processes will be the ones driving productivity and innovation across their sectors.

From faster healthcare onboarding to smarter logistics routing, IDP is quietly transforming how American industries operate—one document at a time.

How Data Automation Enhances Underwriting Accuracy and Speed in Insurance

Underwriting lies at the heart of the insurance value chain. It's where risks are evaluated, premiums are calculated, and the foundation of profitability is laid. However, traditional underwriting processes are time-consuming, heavily manual, and prone to error—especially when dealing with massive volumes of unstructured or inconsistent data.

In an industry increasingly shaped by speed, precision, and customer expectations, data automation is emerging as a game-changer.

The Problem with Manual Underwriting

Underwriters traditionally rely on a mix of structured forms, PDFs, spreadsheets, and even handwritten documents. This leads to:

Delays in decision-making

Data entry errors and inconsistency

Limited capacity to handle large volumes of applications

Suboptimal risk profiling due to incomplete or outdated data

In high-volume or high-complexity cases—such as commercial insurance or health plans—these inefficiencies multiply, causing bottlenecks in policy issuance and customer dissatisfaction.

How Data Automation Makes a Difference

Modern data automation tools—driven by AI, machine learning, and intelligent document processing (IDP)—help streamline and enhance underwriting in several critical ways:

1. Faster Data Extraction

Automated systems can extract data from a wide range of sources: scanned documents, third-party databases, forms, and more. IDP tools convert unstructured data into structured formats instantly, reducing reliance on manual data entry.

Example: A commercial insurance underwriter processing property records and financial statements can now review data within minutes instead of hours.

2. Improved Accuracy

AI-driven automation tools flag anomalies, verify data points across multiple sources, and reduce manual errors. This ensures that risk assessments are based on clean, verified data, leading to more reliable decisions.

3. Enhanced Risk Modeling

With access to real-time data feeds and historical datasets, automated systems can power predictive analytics models. These models enable underwriters to assess risks with greater accuracy, taking into account variables that might have been overlooked manually.

4. Scalability

Automation enables underwriting teams to process more applications with the same or fewer resources—ideal for peak seasons or during a product launch. This scalability ensures insurers remain agile and responsive.

5. Regulatory Compliance

By automating data capture and documentation, insurers can maintain audit trails, ensure data completeness, and meet regulatory requirements more efficiently.

Real-World Impact

A mid-sized U.S. health insurance provider recently deployed a data automation solution for its group policy underwriting process. The results:

Turnaround time reduced by 40%

Underwriting errors dropped by 60%

Customer satisfaction scores improved due to faster policy approvals

Similar success stories are being seen across property & casualty, life, and reinsurance segments as well.

Looking Ahead: Augmented Underwriting

Rather than replacing underwriters, automation augments their decision-making. The future lies in a collaborative model where underwriters use AI-powered tools to handle the heavy lifting of data collection and validation—allowing them to focus on strategic, high-value assessments.

As competition grows and customers demand faster, smarter service, insurers must modernize their underwriting processes. Data automation doesn’t just make underwriting quicker—it makes it better. By improving accuracy, speeding up processing, and enabling deeper risk analysis, it equips insurers to stay ahead in a digitally evolving marketplace.