Blogs, News & Articles

The Fabricator’s Guide to MTR Automation and System Integration

For U.S. steel fabricators, Mill Test Reports (MTRs) are the backbone of quality control, compliance, and traceability. Yet in many shops, these vital documents remain trapped in email attachments, paper folders, or unstructured digital files.

The challenge isn’t just collecting MTRs — it’s connecting them to the systems that drive production, design, and inspection.MTR automation solves this by feeding clean, validated material data directly into your ERP, CAD/CAM, and quality control dashboards, creating a real-time, error-free flow of information across the shop floor.

This post takes you under the hood of how MTR automation integrates with existing steel fabrication systems, with real-world use cases, workflows, and diagrams.

Why Integration Is the Game-Changer

Manual MTR management creates four chronic pain points in fabrication shops:

Double Data Entry – Entering the same information into ERP, spreadsheets, and QC logs.

Production Delays – Waiting for QA teams to manually verify MTRs before issuing materials.

Compliance Risks – Misfiled or missing MTRs leading to failed inspections or rejected work.

Inefficient Traceability – Difficulty linking finished assemblies back to original test reports.

Integration turns MTRs from static documents into live, actionable data, eliminating bottlenecks and reducing risk.

How the Integration Works

The process typically follows these steps:

Ingestion – The system receives supplier MTRs in any format (PDF, scanned image, Excel).

Data Extraction – OCR + AI parsing reads heat numbers, material grade, chemistry, tensile/yield strength, and more.

Validation – Data is cross-checked against purchase orders and compliance rules.

System Sync – Verified MTR data is pushed to ERP, CAD/CAM, and QC dashboards.

Real-Time Access – Production teams can retrieve linked MTRs instantly from any workstation or mobile device.

Integration Architecture Overview

(Diagram already provided earlier – clean, minimalist visual showing MTR Automation Engine as the hub between suppliers and operational systems.)

Use Case 1 – ERP Integration (FabSuite, STRUMIS)

Scenario: Supplier sends 20 MTRs for beams and plates.

Automation Flow:

AI parses each file → matches heat number to PO in ERP.

If data matches, MTR is automatically attached to the job order.

If mismatch or missing data, material is flagged for QA review.

Impact: Eliminates manual typing, reduces PO mismatch errors, and ensures MTRs are always tied to the right project.

MTR Received → OCR & AI Parsing → Auto-match to PO → [Match: Attach & Notify] / [No Match: Flag to QA]

-----------------------------------------------------------------------------------------------------------------------------

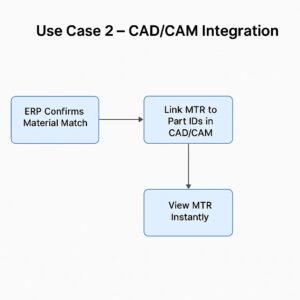

Use Case 2 – CAD/CAM Integration (Tekla Structures, ProNest)

Scenario: Design team needs to link MTR data to part geometry in the CAD/CAM model.

Automation Flow:

ERP confirms material match.

MTR data (heat number, grade) is linked to part IDs in CAD/CAM.

Welders scan QR codes on work orders to view original MTRs instantly.

Impact: Every cut, weld, and assembly is traceable to its original test report — essential for DOT and infrastructure projects.

-------------------------------------------------------------------------------------------------------------------------

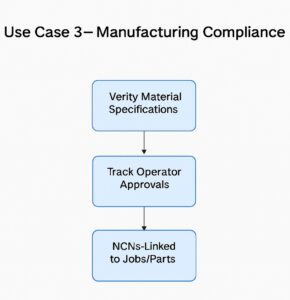

Use Case 3 – QC Dashboard Integration

Scenario: QA manager needs real-time visibility into compliance status.

Automation Flow:

QC dashboard receives structured MTR data with pass/fail flags for ASTM, ASME, AWS standards.

Out-of-spec material is automatically quarantined in the system until resolved.

Impact: Prevents non-compliant material from entering production, avoiding costly rework or penalties.

Key Benefits of Integrated MTR Automation

Feature Manual Process Automated Integration Data Entry Hours/days Minutes/seconds Error Rate High <1% Real-Time Access No Yes Compliance Verification Manual & slow Automated & instant Traceability Paper/email based Digital & searchable Audit Readiness Time-consuming Instant reports Best Practices for a Smooth Integration

Start with Clean Master Data – Ensure purchase orders, supplier codes, and part numbers are standardized before integration.

Use APIs Over Manual Imports – For true real-time updates, API-based integration beats batch uploads.

Pilot with One System First – Begin with ERP or QC integration before adding CAD/CAM.

Involve QA Early – Their requirements for compliance and reporting will guide system mapping.

Automate Exception Handling – Flag and quarantine mismatched or incomplete MTRs automatically.

MTR automation isn’t just a compliance tool — when integrated with ERP, CAD/CAM, and QC systems, it becomes a production accelerator.

Steel fabricators adopting this approach can expect shorter job turnaround times, fewer compliance issues, and fully traceable project histories — all while freeing staff from repetitive admin work.

Why Manual COA Verification Fails GMP Standards

In the pharmaceutical industry, precision isn’t just important—it’s non-negotiable. From batch release to regulatory inspections, every stage of production is governed by strict Good Manufacturing Practices (GMP). Among the most critical documents in this process is the Certificate of Analysis (COA)—a quality assurance report that verifies product compliance with safety and quality standards.

Yet, many pharmaceutical companies still rely on manual methods to verify COAs. While this may have sufficed in the past, today’s regulatory environment, digital compliance mandates, and sheer volume of data make manual COA verification a major liability.

Let’s break down why manual COA handling fails GMP standards—and how automation offers a future-ready solution.

❌ The Problem with Manual COA Verification

1. Human Errors and Inconsistencies

COAs are often received in unstructured formats—PDFs, scanned images, or printed documents. Manually reviewing these documents introduces human error, especially when comparing dozens of parameters across lab systems and supplier data. A single oversight could mean a non-compliant batch reaches the market or a compliant one gets rejected.

2. Delayed Batch Release

Manual verification is time-consuming. QA teams often spend hours per COA cross-checking values against product specifications or material master records. This leads to bottlenecks in batch release, impacting downstream production and delivery timelines.

3. Poor Traceability and Auditability

GMP demands clear, timestamped, and traceable documentation for all quality decisions. Paper-based or spreadsheet-driven processes lack audit trails, making it hard to demonstrate compliance during FDA or MHRA inspections.

4. Compliance Risks with 21 CFR Part 11

Manual COA review processes often bypass electronic recordkeeping standards outlined under 21 CFR Part 11, which governs data integrity, authentication, and electronic signatures. Failing to comply could trigger warning letters or product holds.

✅ The Tech-Driven Fix: COA Automation with AI

At Star Software, we’ve reimagined COA verification through intelligent automation—removing manual friction while enhancing accuracy and compliance.

🔹 Intelligent Document Processing (IDP)

Our system uses AI-powered OCR to extract structured data from unstructured COAs—whether it’s a scanned PDF from a supplier or a digitally signed document. No more manual typing or value-by-value matching.

🔹 Auto-Matching with Product Specs

The extracted data is automatically matched with predefined quality specifications from ERP, LIMS, or MDM systems. Any out-of-spec values or missing data are instantly flagged—reducing decision latency.

🔹 Digital Audit Trails and Validation Logs

Every COA processed generates a secure digital trail, complete with validation logic, user activity logs, and time-stamped approvals—ensuring you’re always audit-ready.

🔹 21 CFR Part 11 and GMP-Ready

The platform supports electronic signatures, access control, and tamper-proof records, aligning with global regulatory requirements for data integrity and electronic documentation.

📈 Real Impact: What Pharma Teams Achieve with COA Automation

Up to 80% reduction in COA processing time

Zero data transcription errors

Audit readiness within seconds

Faster batch release and improved throughput

Better collaboration across QA, procurement, and compliance

👩⚕️ From Risk to Resilience: Future-Proof Your COA Process

As regulators sharpen their focus on data integrity and operational transparency, clinging to manual COA verification is no longer safe—or sustainable. Automation is more than a digital upgrade; it’s a strategic move to align your operations with GMP, accelerate compliance, and safeguard product quality.

Explore how Star Software’s COA Automation platform can future-proof your pharma operations.

Schedule a free demo

AP Automation in the Metal Industry: 12 Frequently Asked Questions

Metal companies operate in a high-stakes environment where even minor delays in invoice processing can ripple through the entire supply chain—making AP efficiency mission-critical.

For metal manufacturers, processors, and distributors, AP automation isn’t just a digital upgrade—it’s a necessity for survival and growth.

At Star Software, we often receive questions from clients across the metal supply chain who are exploring how AP automation can transform their operations. Here, we address the 12 most frequently asked questions to help you make an informed decision.

1. What is AP automation and why does it matter in the metal industry?

AP automation digitizes and streamlines the entire invoice-to-payment process. In the metal industry, where documents like POs, GRNs, and MTRs must be matched with high accuracy, automation ensures timely payments, accurate financial reporting, and enhanced compliance—all while reducing manual effort.

2. How are GRNs and MTRs handled by the automation platform?

GRNs and MTRs are critical documents that confirm product receipt and quality. Star Software’s AI-powered solution reads these documents using OCR and NLP, automatically extracting relevant data and matching them with POs and invoices—ensuring accuracy and preventing mismatches.

3. Can the system handle different invoice formats from multiple vendors?

Yes. Metal companies often deal with suppliers who send invoices in varying formats—PDFs, scanned copies, even handwritten notes. Our Intelligent Document Processing (IDP) engine is trained to handle these inconsistencies without the need for manual intervention or pre-defined templates.

4. Is 3-way or 4-way matching supported?

Absolutely. Our platform performs standard 3-way matching (PO, GRN, Invoice) and extends to 4-way matching by including MTRs. This ensures you’re not only paying for what was ordered and received but also what meets the required quality standards.

5. What kind of ROI can we expect?

Clients typically see:

Up to 70% reduction in manual processing time

40–60% faster invoice approvals

Improved early payment discounts

Fewer late payment penalties

These benefits contribute to a strong return on investment within months of deployment.

6. Can it integrate with our existing ERP system?

Yes. Star Software’s solution is ERP-agnostic and works seamlessly with platforms like SAP, Oracle, Microsoft Dynamics, and other legacy systems. It adapts to your workflows, not the other way around.

7. Does it help with compliance and audit readiness?

Definitely. The system maintains a full digital audit trail, recording every approval, change, and transaction. This not only supports internal controls but also makes external audits faster and more transparent.

8. Will our vendors need to change how they submit invoices?

No. Your suppliers can continue using their existing formats and methods—email, scans, or PDFs. The system adapts to them, ensuring a frictionless vendor experience and faster onboarding.

9. What’s the typical implementation timeline?

Most metal businesses can expect to be live in:

4–6 weeks for basic AP automation

8–10 weeks for advanced automation (with GRN, MTR, and ERP integration)

Our deployment process includes configuration, testing, training, and go-live support.

10. Is it easy for our AP team to use?

Yes. The platform is intuitive, requiring minimal training. Most AP professionals are up and running within days. Star Software also provides onboarding support and knowledge resources.

11. How are exceptions or errors handled?

If there are mismatches or anomalies during invoice processing, the system flags them in real-time and routes them to the appropriate approvers via a centralized dashboard—eliminating the need to manually investigate documents.

12. Is our data secure with this solution?

Security is a top priority. The platform uses end-to-end encryption, role-based access, and is hosted in secure, compliant environments that meet ISO and GDPR standards.

In a sector where time, quality, and compliance are non-negotiable, AP automation delivers the agility and control that metal companies need. Whether you're looking to reduce manual work, improve vendor relationships, or gain real-time insights into cash flow, automating your AP process is a strategic move.

Interested in seeing how AP automation can work for your operations?

Get a free demo from Star Software and experience the difference. You may have a look at the other FAQs related to AP automation too.

How AI Simplifies PO-GRN-MTR Invoice Reconciliation in Metals

In the metal sector, managing invoices and ensuring they align with purchase orders (PO), goods receipt notes (GRN), and mill test reports (MTR) is critical for maintaining smooth operations. However, the manual reconciliation of these documents can be labor-intensive, error-prone, and time-consuming. With increasing demands for accuracy, speed, and efficiency, the industry is turning to automation and AI-powered solutions to streamline invoice matching.

In this blog, we’ll explore how AI-driven invoice automation tools are revolutionizing the way the metal sector reconciles invoices with POs, GRNs, and MTR data, improving accuracy, reducing delays, and enhancing supplier relationships.

The Traditional Invoice Matching Process:

Traditionally, invoice reconciliation in the metal sector requires verifying and matching multiple documents:

Purchase Orders (PO): The agreement between the buyer and supplier specifying the items, quantities, and prices.

Goods Receipt Notes (GRN): A document issued to confirm that the goods have been received in the correct quantity and condition.

Mill Test Reports (MTR): These reports provide details about the quality and specifications of the metal products, ensuring the delivery meets agreed standards.

The manual process typically involves cross-referencing these documents against the invoice received from the supplier. Any discrepancies, such as mismatched quantities, incorrect prices, or missing certifications, can result in delays, payment issues, and strained relationships.

The Role of AI in Invoice Matching:

AI-powered invoice automation tools bring transformative benefits to this process, enabling businesses in the metal sector to streamline and accelerate reconciliation. Let’s break down how AI assists in each phase of invoice matching:

1. AI-Driven PO Matching:

With AI, purchase order data is automatically extracted from documents and matched with the corresponding invoice. This automated system identifies discrepancies such as differences in prices, quantities, and product specifications. AI doesn’t just flag errors; it also learns from previous data and continually improves its ability to identify discrepancies, making the process faster and more accurate over time.

For example, AI can quickly spot discrepancies between the quantities listed on the PO and those mentioned in the supplier’s invoice, reducing the need for manual checks.

2. Seamless GRN Integration:

Once the goods are received, the GRN ensures the correct items and quantities are accounted for. AI integrates the GRN data with both the PO and the invoice, automatically identifying any mismatches in goods received vs. goods invoiced. This integration minimizes the risk of overpayment for items that were not delivered in full or discrepancies in shipping details.

AI can also track the status of the GRN in real-time, allowing finance teams to know when the invoice is ready to be processed, further speeding up the cycle.

3. MTR Data Validation:

Mill Test Reports (MTR) are essential in verifying that the delivered metals meet the agreed-upon specifications and standards. AI-based tools can scan and extract MTR data from reports, validating them against the details in the PO and invoice. This includes checking for certifications, material grades, and compliance with regulatory standards.

AI reduces the manual effort of cross-checking test results by automating the comparison of MTRs with the invoiced products, ensuring quality and compliance before the invoice is processed for payment.

4. AI-Powered Discrepancy Resolution:

AI not only identifies discrepancies between these documents but can also suggest resolutions based on historical data. For example, if the system detects a mismatch in quantities, it can automatically suggest whether the supplier needs to be contacted for a correction or if a partial payment is justified. This reduces human involvement and speeds up decision-making.

Additionally, AI’s ability to learn from past discrepancies means it gets better at recognizing patterns and can recommend automated workflows for common issues.

Benefits of AI-Powered Invoice Matching in the Metal Sector:

1. Accuracy and Reduced Human Error:

Manual invoice matching is prone to errors, whether from data entry mistakes or oversight in reviewing complex documents. AI automates data extraction and matching, drastically reducing the likelihood of human error. This enhances accuracy across all stages of the invoicing process.

2. Faster Invoice Processing:

By automating the matching of PO, GRN, and MTR data, businesses can significantly reduce the time spent on manual invoice processing. AI tools can instantly match documents, flag discrepancies, and even resolve common issues, leading to quicker approval and payment cycles.

3. Improved Cash Flow Management:

With faster and more accurate invoice reconciliation, businesses can manage their cash flow more efficiently. Automated invoice matching helps ensure that invoices are processed promptly, avoiding late payment penalties and fostering stronger supplier relationships.

4. Cost Savings:

Reducing the manual labor involved in invoice reconciliation lowers operational costs. Automation also helps businesses take advantage of early payment discounts and avoid late fees, contributing to long-term cost savings.

5. Better Supplier Relationships:

Accurate and efficient invoice processing leads to fewer disputes with suppliers over pricing, quantities, or quality issues. AI helps to foster trust by ensuring transparency in the invoicing process and quick resolution of discrepancies.

In the metal sector, where precision, compliance, and efficiency are critical, invoice matching is an essential yet challenging task. By leveraging AI-driven automation, companies can overcome the traditional hurdles of manual reconciliation and ensure smooth, error-free invoicing. From PO to GRN to MTR data alignment, AI is the key to transforming how invoices are processed, making the metal sector more agile, cost-effective, and competitive.

Incorporating AI into the invoicing process not only saves time and money but also enhances accuracy, improves supplier relationships, and optimizes cash flow. As automation continues to evolve, businesses in the metal industry that embrace these technologies will be better equipped to navigate the challenges of the future while staying ahead of the competition.

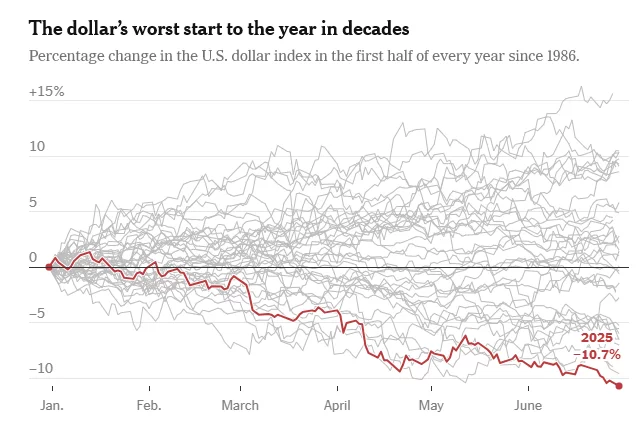

Strong Metals, Weak Dollar: Why Compliance Matters Now

The recent slide of the U.S. dollar is stirring waves far beyond the currency markets — and the American metal industry is feeling the ripple effects. While a weaker dollar may benefit exporters by making U.S. goods more competitive abroad, the situation is far more complex. Inflationary pressures, evolving tariff policies, and compliance demands are creating a tightrope walk for manufacturers, traders, and investors.

What the Weakening Dollar Signals

At face value, a depreciating dollar typically boosts U.S. exports by making them more affordable for foreign buyers. This should be a tailwind for American metal producers shipping steel, aluminum, and other raw materials overseas. However, in today’s volatile economic climate, the dollar’s fall is being read as a warning signal.

As Steve Englander of Standard Chartered aptly puts it, “Having a weak dollar or a strong dollar isn’t the issue. The issue is: What is it telling you about how the world sees your policies?”

Initially buoyed by pro-growth sentiment around the Trump administration’s economic policies, the dollar peaked in early 2025. But the optimism was short-lived. Concerns over high interest rates, stubborn inflation, and aggressive tariff rhetoric spooked investors. The result? A slide in confidence toward U.S. assets, including metals.

Metal Sector in Flux: Between Demand and Disruption

For domestic producers, the weakening dollar presents both opportunities and challenges:

Export Boost: A cheaper dollar could increase global demand for U.S.-made steel and aluminum, especially in emerging markets.

Costlier Imports: On the flip side, metal manufacturers reliant on imported raw materials or machinery are facing higher input costs.

Tariff Uncertainty: The looming threat of new tariffs disrupts predictable trade flows, further complicating sourcing and pricing strategies.

What should be a straightforward export advantage is now a delicate balancing act. Tariff threats and global trade instability undermine long-term planning, with buyers and suppliers alike becoming more cautious.

The Hidden Hero: Compliance

Amid these uncertainties, regulatory compliance has emerged as a silent stabilizer for the U.S. metal industry.

Exporters must now double down on transparent documentation — including Material Test Reports (MTRs), Certificates of Origin, and Certificates of Analysis (CoAs) — to meet international trade standards and avoid costly delays or rejections.

Compliance plays three critical roles:

Risk Mitigation: In a climate of shifting tariffs and trade scrutiny, compliant documentation helps de-risk international shipments.

Trust Building: Global buyers demand traceability and accountability — accurate paperwork earns their confidence.

Automation Advantage: Companies that automate compliance workflows are staying leaner and more agile, turning what was once a back-office function into a strategic differentiator.

Conclusion: Strengthening Through Smart Strategy

The weakening dollar, driven by concerns over inflation, tariffs, and investor confidence, is a wake-up call for U.S. manufacturers — especially those in the metals sector. In this uncertain environment, compliance isn’t just a legal obligation — it's a competitive weapon.

By embracing automated documentation systems and staying ahead of regulatory shifts, American metal producers can transform short-term currency volatility into long-term trade resilience.